StableValueFunds EverythingYou

Stable Value Fund at a Glance

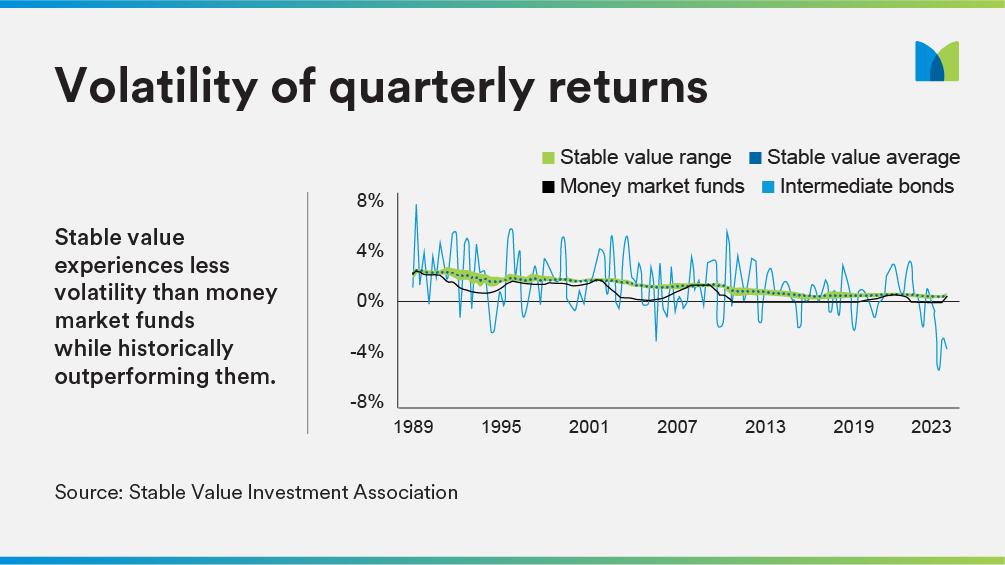

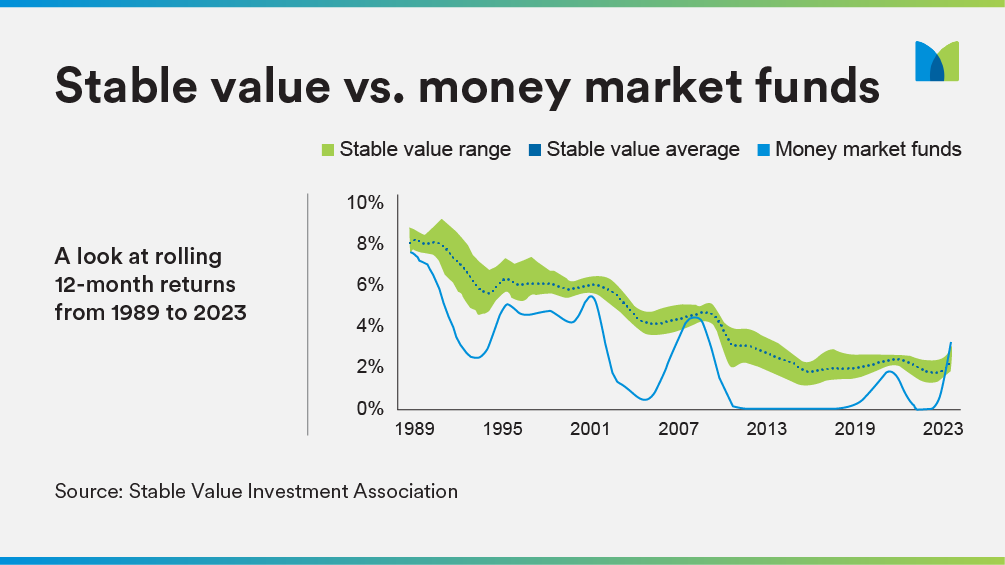

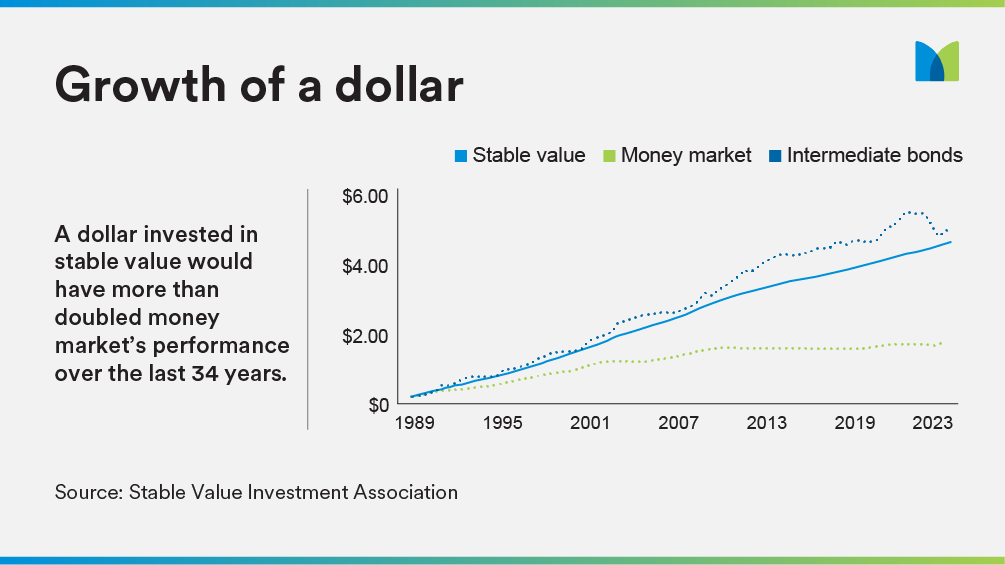

Stable value funds provide a reliable way to generate steady returns over time while minimizing volatility. Stable value funds have historically outperformed both money market funds and the rate of inflation, which has made them a go-to capital preservation option for defined contribution plan sponsors.

What is a stable value fund designed to do?

How does stable value work?

What is a stable value crediting rate?

Stable value’s performance vs. other capital preservation options

Tips for researching stable value funds

What is a stable value fund designed to do?

These funds typically invest, directly or indirectly, in high-quality short-term and intermediate-term bonds. What differentiates stable value funds from bond funds is the insurance contract: stable value is a bond portfolio covered by an insurance “wrap” that guarantees the investor receives their principal and the agreed-upon interest rate regardless of the market value of the assets in the portfolio.

This helps reduce the participant’s overall market risk, provides stability that helps them feel more confident about investing for their future and enables them to build more diverse retirement portfolios.

In addition, for those currently in retirement, stable value is well suited to help retirees preserve the wealth they’ve accumulated at a time when they can least afford to experience a significant loss in portfolio value since they do not have an extended time frame from which to recover from adverse market outcomes.

How does stable value work?

These wrap contracts enable plans to hold the assets supporting the contract at “book value.” Book value allows securities to be held at the price paid for them plus interest at a rate determined by a crediting rate formula included in the contract regardless of the market value. These contracts provide daily liquidity for participants to transact at book value, regardless of the current market value of the assets.

Stable value can take many forms, including collective investment trusts, separate account GICs, traditional GICs, synthetic GICs and insurance company evergreen general account solutions.

Collective Investment Trusts

Collective Investment Trusts (CITs), also known as pooled funds, pool the assets of multiple plans together, enabling smaller plans to gain access to stable value.

Originally designed as an investment vehicle for defined benefit plans, CITs have evolved to become a popular choice for defined contribution plans. CITs are available across multiple asset classes, including stable value, are available only to institutional investors and are subject to the oversight of state banking regulators or the Office of the Comptroller of the Currency (OCC). CITs also often have lower fees than mutual funds.

Traditional Guaranteed Interest Contracts

Guaranteed Interest Contracts (GIC’s) have been a key component of stable value funds since the beginning of the asset class. And for good reason. Through GICs, stable value meets two important needs for retirement plan participants: principal protection and steady growth by earning a competitive interest rate.

GICs are popular retirement plan additions because of their simplicity and flexibility. GICs are issued by insurance companies, invested in the general account and backed by the full faith and credit of the insurer. GICs have a defined maturity date with a set interest rate for a fixed period of time. GICs can also be structured with floating interest rates that reset periodically based upon a stated spread to a specific index such as SOFR.

Separate Account Guaranteed Interest Contracts

Separate Account GICs combine the best features of traditional general account products — guarantee of principal and interest for retirement plan participants1 — with added investment flexibility, control, transparency, and security in one comprehensive package.

Separate Account GICs are not held in the insurer’s general account, but instead are invested in one or more individual or commingled (pooled with other assets) separate accounts owned by the insurance company. The assets can be managed by either the insurance company or can be sub-advised by a variety of best-in-class asset managers. These separate account assets are segregated from the assets of the insurer’s general account. The assets are only for the beneficial interest of the plans that participate in the separate account and are not subject to the liabilities of the insurers general account.

Unlike Traditional GIC’s that have a defined maturity date and set rate of interest for the term, Separate Account GIC’s are evergreen in nature and do not have a defined maturity date. As a result, the interest rate under a separate account resets periodically, typically quarterly.

Synthetic Guaranteed Interest Contracts (GIC)

The primary distinguishing factor of a Synthetic GIC is that unlike in a Separate Account structure, where the insurance company owns the assets, in a Synthetic GIC, the portfolio of bonds is owned by the plan or trust and managed by an asset manager selected by the plan sponsor. The plan sponsor also enters into a contract(s) with a wrap provider(s) to provide the book value accounting around the asset portfolio.

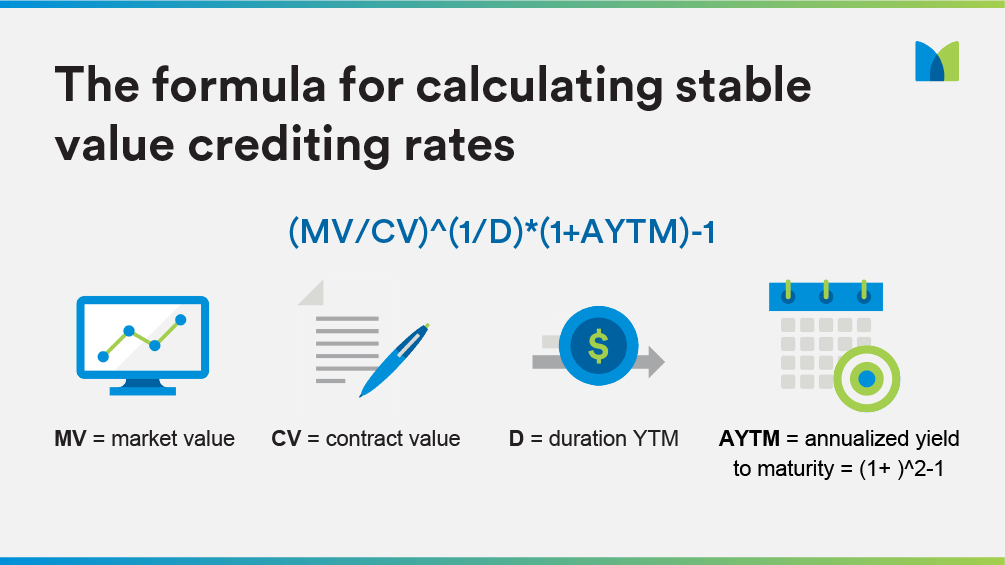

Synthetic GICs have a crediting rate that resets periodically (monthly, quarterly, etc.) based upon a contractual formula that amortizes market value gains and losses over the duration of the portfolio. Otherwise, they offer the same benefits you would expect from other stable value contract types.

What is a stable value crediting rate?

In a Traditional GIC or an insurance company evergreen general account solution, the crediting rate is the interest rate established by the insurance company for the defined time period.

For pooled funds (CIT’s), separate account GIC’s and Synthetic GIC’s, the net crediting rate is effectively the yield of the underlying portfolio minus expenses along with an amortization of market value gains/losses over the duration of the asset portfolio. Crediting rates track the general direction of interest rates with a slight lag in both rising and falling interest rate environments.

This means participant values do not change daily due to day-to-day changes in the market values of the underlying portfolio of assets. Stable value smooths out the underlying market volatility by resetting the crediting rate periodically.

Stable value’s performance vs. other capital preservation options

Comparing stable value to intermediate bonds can be challenging, as intermediate bonds have been highly volatile relative to stable value. However, a dollar invested in stable value 24 years ago would have returned nearly the same as a dollar invested in intermediate bonds but with far less volatility during that time period. That same dollar invested in money market funds would have returned less than half.

Tips for researching stable value funds

- Look at consistency of performance across multiple time periods, for example, 1-, 3-, 5-, 10-year and since-inception returns.

- Don’t compare net crediting rates in a vacuum. Consider the underlying investment strategy and investment managers that support that crediting rate.

- Compare the historical market-to-book ratio against other funds and the prevailing market environment, not just whether it’s above or below 100%.

- Don’t look at fees in isolation. Evaluate fees holistically, as it’s important to understand what you’re getting for the fees you’re charged. Selecting a well-run diversified stable value fund backed by a top-rated guarantor(s) that charges a little more can add value if it generates higher returns.

- Consider a funds exit provision and the impact that has on the investment philosophy, duration and crediting rate. Funds with a 12-month put exit provision will typically have a shorter portfolio duration while funds with the lower of book or market value exit will typically have a longer duration profile.

MetLife and stable value funds

Test

MetLife has an over 45-year history in stable value and offers creative and tailored solutions backed by extensive knowledge and experience. Our team consists of industry leaders with a long track record in stable value.

Test

MetLifes StableValueStudy isthe

Test

Ifyouare aplansponsor oradvisor