Evaluating a Stable Value Fund

How do you identify the best stable value option for your defined contribution plan?

Stable value funds have played a key role in defined contribution plans for nearly a half century, and plan sponsors now have more options than ever. With more than 50 solutions to choose from across a range of providers and product types, how do you identify the best stable value option for your plan?1

Below we cover the things you should know, and address some of the most commonly asked questions around evaluating and selecting a stable value fund.

Why do plan sponsors offer stable value funds?

SV historical performance vs. other principal preservation options

5 Key Things to Consider When Selecting Your SVF

How do stable value funds respond to changes in interest rates?

How do you evaluate the underlying investments in a stable value fund?

Why do plan sponsors offer stable value funds?

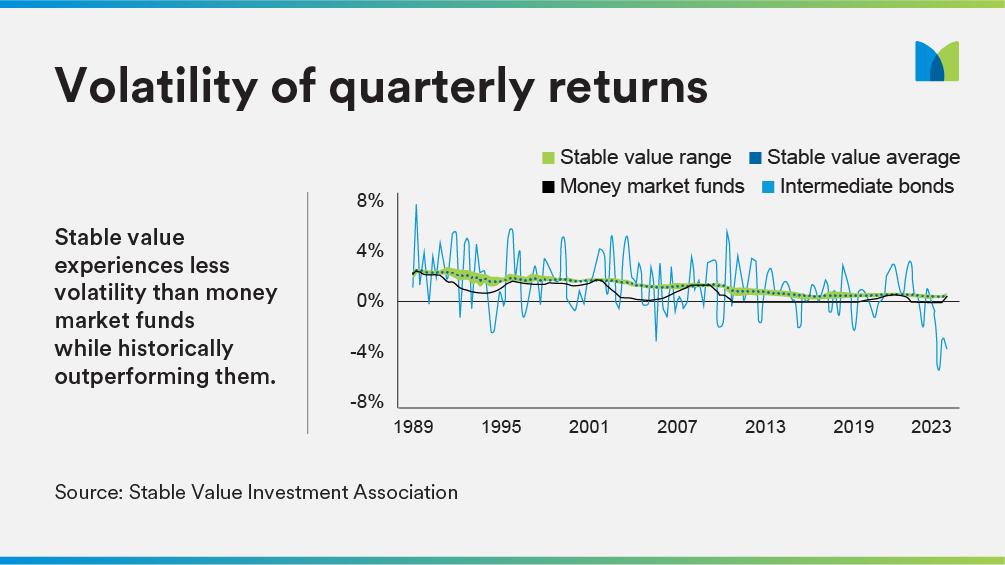

Stable value offers protection from market volatility while providing principal protection and a guaranteed interest rate. Liquidity for participant-initiated activity is available on a daily basis at book value. These funds package a portfolio of high-quality, short- to intermediate-duration bonds with an insurance “wrapper.” This wrap, provided by an insurance company or a bank, guarantees principal and accumulated interest regardless of what happens in the market.

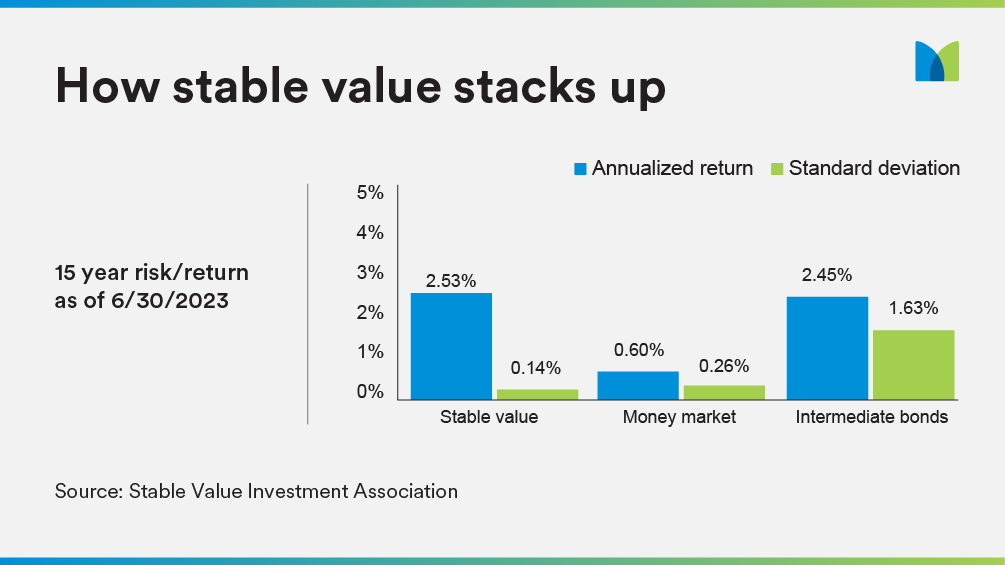

Also, plan advisors overwhelmingly recommend stable value. Our latest study found that 82% of plan sponsors said their advisor recommended stable value — and 90% of those plan advisors said outperformance compared to money market funds was a key reason.2

SV historical performance vs. other principal preservation options

5 Key Things to Consider When Selecting Your SVF

Performance

The more consistent the performance of a stable value fund, the better. When comparing returns, make sure to look at multiple time periods, including one-, three-, five- and 10-year returns. You will want to see:

- Consistent performance with a demonstrated track-record

- Funds that consistently outperform their peers

- Funds offered by companies with a core competency in stable value , such as MetLife.

Historical net crediting rates Guaranteed Interest Contracts

Historical market-to-book ratios

Stable value funds are typically comprised of a portfolio of bonds. The market value of the fund’s holdings fluctuates as interest rates rise and fall. Bonds have an inverse relationship with interest rates. When rates go down, the market value of those securities goes up. And the opposite is true: When rates go up, the value of the securities goes down. Stable value funds smooth market volatility and are designed to have market value ratios that are at times below 100% and at times above 100%.

In general, a fund’s market-to-book ratio should be evaluated relative to the prevailing market environment and other stable value funds, rather than as a stand-alone measure.

Expenses

Exit Provisions

It is also important to understand a fund’s exit or termination provision and the impact that has on the structure of the fund. Stable value funds can have a variety of exit provisions including a 12-month put at book value, the lower of market or book value, or installments over a period of time. The most common exit provision is the 12 -month put at book value.

This enables a plan to exit the fund at full book value upon 12 months’ advance notice. The lesser of book or market value allows a plan to exit the fund at any time. The value the plan would receive upon exit is the lower of the book or market value. If market value is below book value, a plan can wait until market equals book and exit immediately at that time if they so choose.

Other solutions, such as insurance company evergreen general account funds, provide for a series of installment payouts at book value. A typical example would be five annual installments to complete the termination process. Because 12-month put funds require a full book value payment in only 12 months, they tend to have a shorter investment duration, typically two to three and a half years.

The lesser of market or book value funds tend to have a longer investment duration, since plans cannot receive a book value payment unless the market value of the assets is at or above the book value. Likewise, insurance company general account funds tend to have a longer investment duration, since any exit from the fund would be paid out over a series of installments, often extending out five years.

How do stable value funds respond to changes in interest rates?

A stable value fund’s track record is an indicator of its ability to perform in various market conditions. It’s important to look at various intervals of that record — such as one, three, five and 10 years — for a more complete picture. It’s also important to look at the track record and experience of the entities that comprise the fund, such as the fund sponsor, asset managers and wrap providers.

New funds may have little-to-no track record. A proxy for a new fund’s track record is the experience and historical performance of the investment manager in the investment mandate they are managing in the fund. The experience, size and demonstrated track record of the wrap provider(s) is also important.

When considering a new stable value fund, look at who is sponsoring the fund, who is managing the underlying assets and who is providing the insurance wrap. If each of these parties have track records of consistent performance and reliability, that’s a strong signal that the new fund may perform well.

How do you evaluate the underlying investments in a stable value fund?

MetLife’s stable value solutions

Stable value is a core competency of MetLife, our financial strength ratings are among the highest in the industry.3 Our extensive expertise managing both assets and liabilities, and our over 155-year heritage of financial stability and strength, make us the preferred provider for many stable value managers and retirement plan sponsors. To learn more about our stable value solutions, please contact our stable value team at (833) 948-2275.