Retirement

Your Roadmap to Retirement

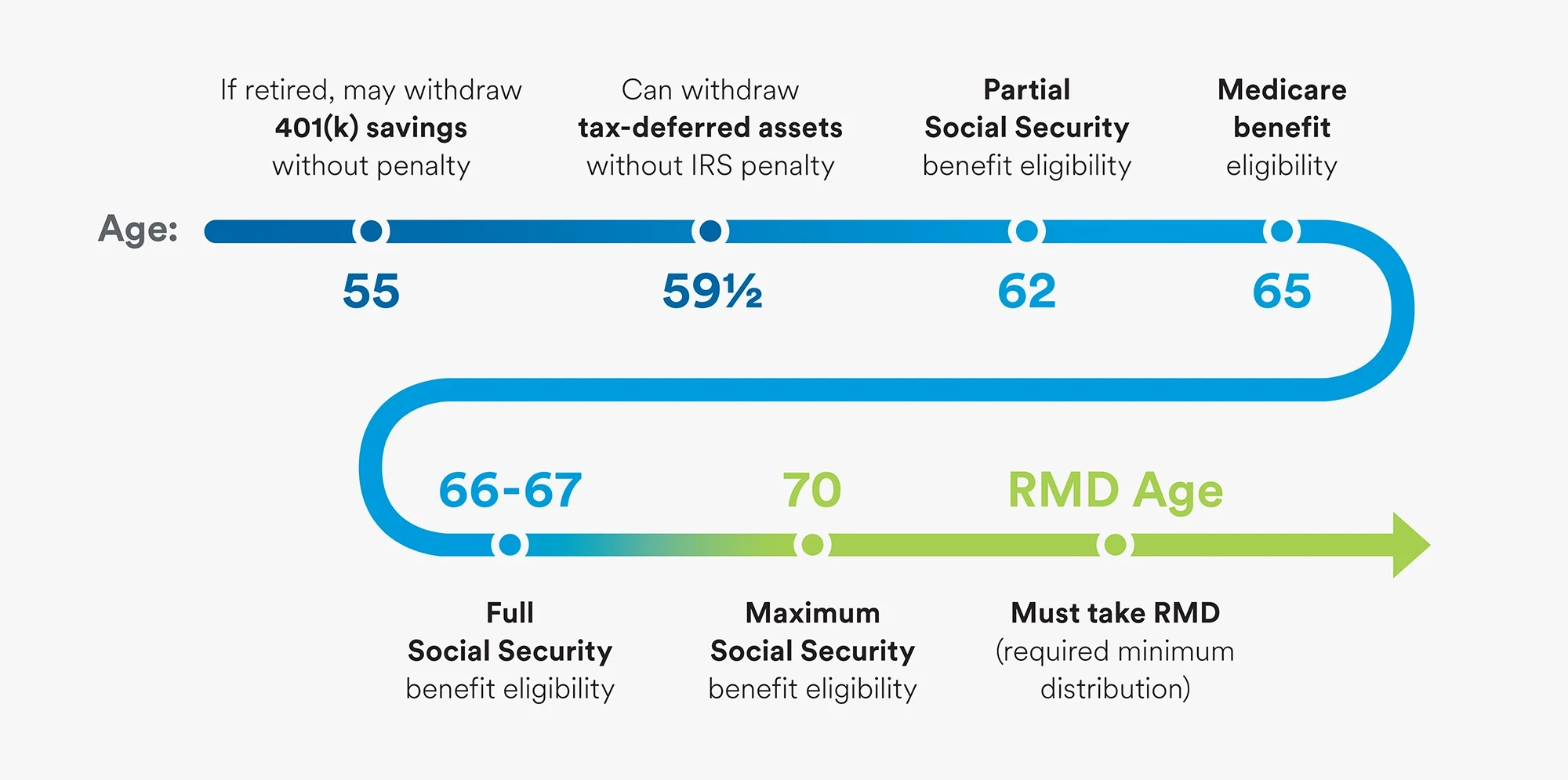

Like many life stages, retirement is a journey that is unique from one person to the next — and everyone's road to retirement will be different. However, there are seven major milestones in retirement that everyone faces. Whether you are planning for retirement or close to retiring, it’s important to familiarize yourself with these important milestones. By understanding them early on, you will be in better place to make decisions that will help you enjoy a more comfortable and secure retirement.

Retirement Milestones1

Build Your Personalized Retirement Roadmap

Now that you are familiar with the milestones along the road to retirement, here are five steps that you can take now to help you build your personalized retirement roadmap.

1. Learn about Social Security benefits

If you are qualified to receive Social Security benefits, it’s important to know that the benefit amount you will receive will vary based on when you start receiving your income. Even though you can begin collecting as early as 62, full social security benefits begin at “full retirement age,” based on your year of birth. To learn more visit www.ssa.gov and use the Social Security Retirement Estimator tool.

2. Calculate your total assets and investments

Total the amount of assets and savings you have set aside (for example, employer-sponsored 401(k) plan, pension plan, IRA, other savings and investments), plus any income you will be receiving in retirement. It’s important to plan for at least 20 to 30 years of retirement. Review our Retirement Income 101 infographic to learn more about the variety of retirement income sources.

3. Learn about healthcare coverage: Medicare options and/or private insurance

Understanding the alphabet soup of Medicare choices can be daunting. Visit www.medicare.gov to learn more about how to personalize your Medicare options.

4. Determine your monthly retirement budget

Calculating your expenses in retirement is an important step to help determine what you will need on a monthly basis. To get started, consider trying our Retirement Income Tool to estimate if your monthly retirement income will be enough to replace your paycheck.

5. Develop an income plan to cover your expenses

Consider a lifetime income option available through your employer which will provide you with a guaranteed stream of income for the rest of your life.2 Contact your human resources department to find out what options may be available to you.

Will you have enough income in retirement?

Use MetLife’s interactive tool to discover if you have a retirement income gap—the difference between your anticipated retirement income and estimated monthly expenses.