Stable value funds (SVF) are a smart way to help defined contribution plan participants preserve their principal and earn steady, guaranteed positive returns. Stable value’s returns have historically topped money market funds and outpaced inflation with exceptionally low volatility.

But there’s more to consider than yield and the financial strength of the insurer when selecting a stable value fund. It’s important to know what features a fund includes and how those features might empower you — or limit you — in making changes in the years ahead.

When evaluating stable value for your defined contribution plan, here are five key features to consider and help you make an informed choice.

1. Performance and net crediting

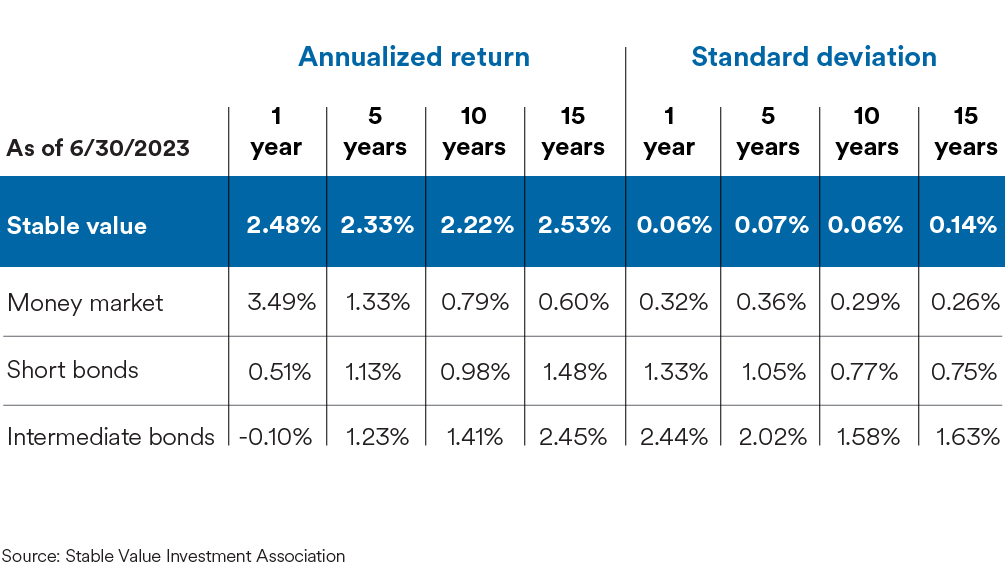

When you compare returns, don’t just look at short-term performance. Instead, look at an SVF’s 1-, 5-, 10- and 15-year returns. The reason: these long-term returns will offer insights into how the fund performs in all types of markets and interest rate environments. What you’re looking for is an SVF with consistent, stable and competitive returns.

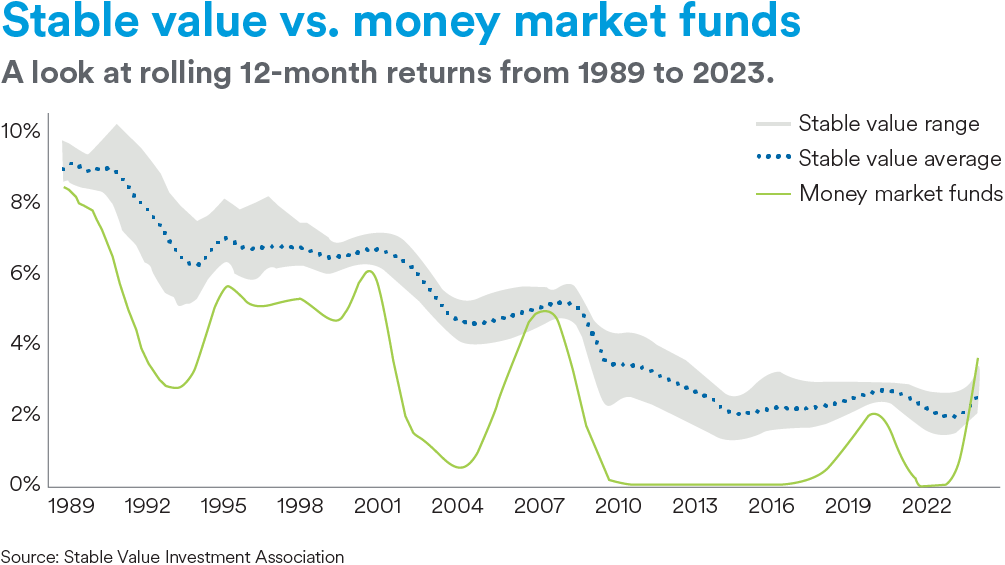

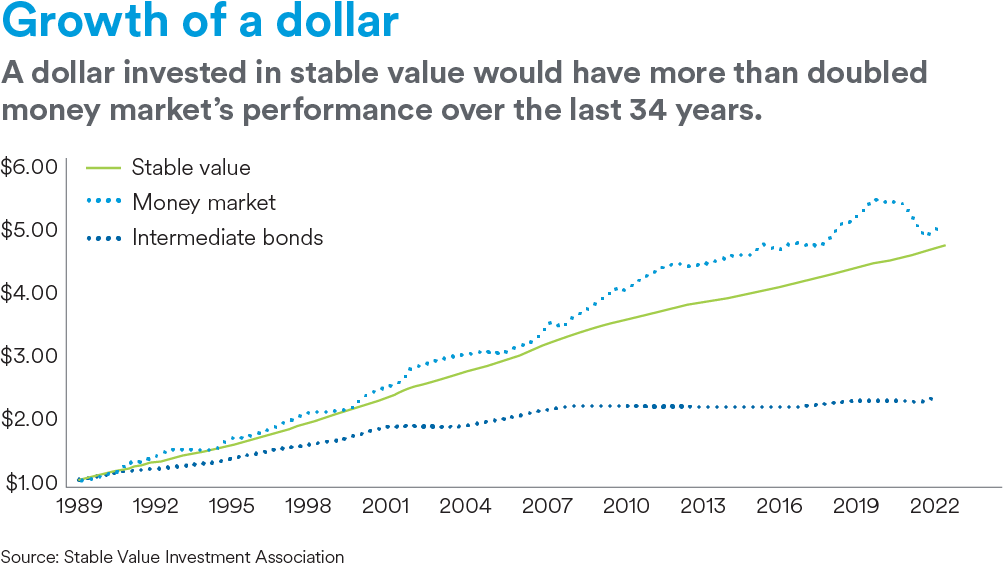

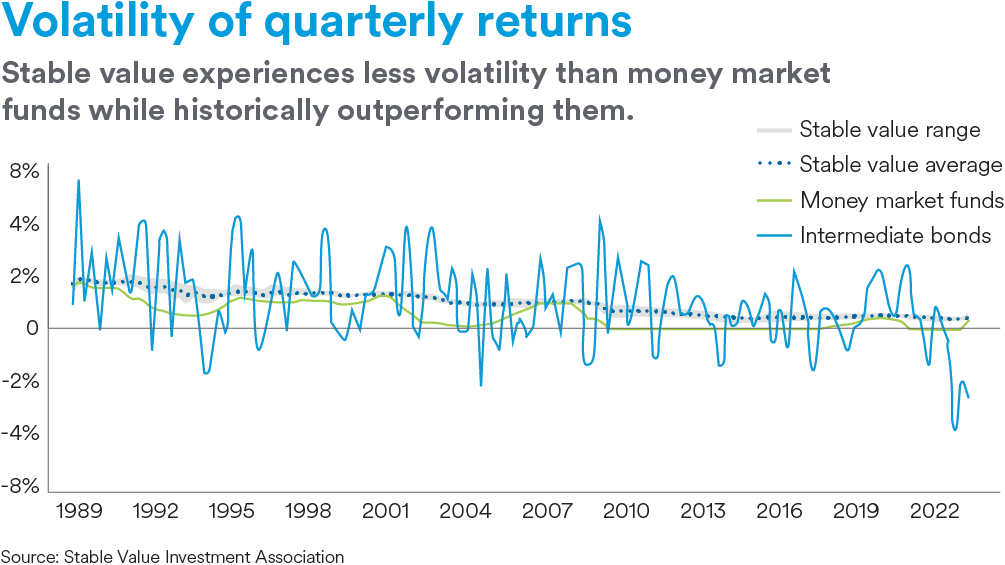

Performance is part of the appeal of stable value funds. A key attribute of SVFs is that they have historically generated higher returns than money market funds thanks to their investment in longer-dated, higher yielding assets. In fact, the returns SVFs generate is more in line with the higher yields of intermediate bonds. The return stream of stable value is also steadier and comes with less return volatility than money market funds.

When looking at return, it’s also important to focus on net crediting rates — the return, or yield — guaranteed by the wrap providers after expenses. The insurance contract backing an SVF’s yield is what enables the fund to deliver smooth returns, rather than more volatile price moves.

2. Historical market-to-book ratios

Due to price fluctuations in the bond market, a stable value fund’s book value, or contract value, may be higher or lower than the market value of the fund’s holdings.

A “market-to-book ratio” above 100%, for example, means the market value of the stable value fund’s assets is greater than the contract value. In contrast, a market-to-book-ratio below 100% that results from conditions that arise such as; a rise in interest rates means the market value has dipped below the contract value.

These fluctuations are expected and factored into the mechanics of the fund. Stable value pays plan participants the guaranteed crediting rate regardless of whether the market-to-book ratio is above or below 100%. As a general rule, you just want to make sure that the relationship between the SVF’s contract value and market value is in line with other similar funds.

Since market volatility is a given, it’s best not to view an SVF’s market-to-book ratio as the main factor in your selection process. You should also consider how an SVF’s historical return compares with its peers’ as well as evaluate its underlying investment strategy and portfolio diversification to ensure that they are sound, proven and time-tested.

Given the inverse relationship of bond prices and yields, it’s important that you also evaluate a stable value fund’s market-to-book ratio in conjunction with market conditions at any given point in time and interest rate forecasts. That said, stable value is designed to amortize gains and losses over time through the crediting rate reset formula, thereby preserving capital and smoothing volatility.

An SVF should be offered by plan sponsors as a long-term plan option — not an investment to be used to “time the market.”

3. Fund discontinuance/exit provisions

Portability is another key SVF feature to consider. It’s important to know what your options are if you want to discontinue the SVF contract and either move to a new record keeper or exit a fund altogether.

In general, if the SVF’s market value is above the contract value the plan sponsor may be able to leave the fund immediately. Though, it should be noted that some funds will require the full 12-months’ notice, also known as a 12-month put. It’s when the market value falls below contract value that exit provisions are impacted. With respect to funds that have exit provisions that pay the lesser of market or book value, the plan sponsor, of course, can avoid market value adjustments by waiting until the SVF’s market value gets back to the contract value before exiting the fund.

Many SVFs, for example, have a “portability” feature that allows the plan to stay invested in the fund when moving to a new record keeper, rather than having to exit and reinvest the assets in a new fund. The biggest benefit of this feature is the plan sponsor’s flexibility in selecting a new record keeper.

4. Expense ratios

Just as you would review fees charged by any investment option in the plan lineup before you invest, it’s also prudent to analyze fees of stable value funds.

A stable value fund with the lowest fee isn’t necessarily the best fund from a performance standpoint. Evaluate the SVF holistically, as it’s important to understand what you’re getting for the fees you’re charged. Selecting a well- run, diversified SVF backed by a top-rated guarantor(s) that charges a little more can add value if it generates higher returns. In addition, when weighing fees, it’s best not to focus on the absolute fee amount, but rather view fees in the context of the SVF’s net return to the plan participant. It’s quite possible, for example, that a stable value fund that charges a higher fee than a competing fund will still produce a higher annual return.

5. Bond diversification and duration

The adage “know what you own” applies to stable value funds as well. It’s important to understand the underlying bond portfolio and how the types (and durations) of the bonds the stable value fund holds will impact performance.

While SVFs typically invest in high-quality bonds, both the risk and yield of one stable value fund versus another will depend on factors such as the fund’s investment process, asset allocation (e.g., the types of bonds the fund invests in and how big a weight each bond type has in the portfolio) and the overall duration of the bonds in the portfolio.

The more diversified the stable value fund, the more likely it will be able to weather market volatility with minimal impact. SVFs typically invest in short- to intermediate-term U.S. Treasuries, high-quality corporate bonds and other fixed income assets. Duration measures the price sensitivity of the fund due to changes in interest rates. Bonds with shorter maturities are less impacted by rate changes than longer-term bonds.

Choosing the right fund for your plan

As you evaluate all of the stable value options available to you, bear these five considerations and features in mind. Choosing the right SVF can provide long-term stability for your portfolio, steady returns and help secure your participants’ future.