Guaranteed retirement income is expected to be the next big enhancement to defined contribution (DC) plans thanks to regulatory changes enacted through the SECURE Act of 2019 that made it easier for plan sponsors to offer guaranteed retirement income options in DC plans by providing a fiduciary safe harbor. That’s good news for plan sponsors since they play a critical role in facilitating successful retirement outcomes for their DC plan participants.

For those plan sponsors not yet offering guaranteed income, it’s no longer a question of if they should offer them but rather when and which solutions. This whitepaper is intended to help with those evaluations to select the best retirement income option(s) for your DC plan participants.

Demand for Guaranteed Retirement Income is Growing

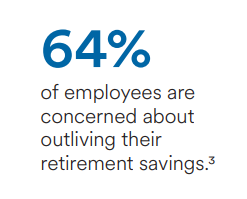

Today, many U.S. employees rely on their DC plans as their primary source of retirement savings. While supporting retirement plan savings is incredibly important, that’s only one piece of the workplace retirement plan equation. DC plans may fall short in providing an income stream in retirement. This is a serious shortcoming, given that workers fundamentally do not understand how much they will need to maintain their current lifestyle and may underestimate the length of time they may be living in retirement, which could be 20 to 30 years or more.

Among employees, 9 in 10 retirees and pre-retirees feel it’s valuable to have a guaranteed monthly income,1 while 94% of employees with a DC plan say they would like their employer to provide them with ways to convert some or all of it into a stream of income when they retire.2

Among employees, 9 in 10 retirees and pre-retirees feel it’s valuable to have a guaranteed monthly income,1 while 94% of employees with a DC plan say they would like their employer to provide them with ways to convert some or all of it into a stream of income when they retire.2

It’s not just employees who want guaranteed retirement income; consultants and recordkeepers are seeing the industry move toward including retirement income in DC plans.

Since the SECURE Act of 2019, two-thirds of consultants have conducted due diligence and/or have met with investment committees to discuss retirement income.4 While consultants say 11% of their clients have added guaranteed retirement income, they believe about 27% of their clients, on average, are or will consider offering retirement income options in their DC plan.5

Retirement Income Solutions Becoming More Prevalent in DC Plans

At MetLife, we are seeing an increase in plan sponsors and recordkeepers offering retirement income solutions on their platform. Other providers are also noticing this increased interest in guaranteed income and are responding by creating new solutions, and there are even some new providers entering the market.

This means there are more options for you, your consultant, and other stakeholders to familiarize yourselves with—which may add more complexity as you evaluate the products, the insurers who provide those products, and the processes used to implement products and related services.

To help streamline and simplify the rigorous review process involved in adding a guaranteed lifetime income solution to your DC plan, we created the following questions to help guide you and other decision-makers you may be working with.

Considerations for Selecting an Insurer

As you consider an annuity for your DC plan, the choice of insurance provider is fundamental. After all, your participants will face what may be several decades in retirement and it is important for them to know that they can rely on the support of a financially strong company with a successful history of delivering on its promises through every type of market cycle. Here are some questions to discuss with your recordkeeper and consultant when recommending an insurer for an annuity option offered to DC plan participants:

- What are the insurer’s financial strength ratings?

Does the insurer have a trusted, recognizable brand name that your plan participants will be familiar with?

Does the insurer have a trusted, recognizable brand name that your plan participants will be familiar with?- What is the insurer’s commitment to the DC market?

- What is the insurer’s experience in the DC market?

- Are they currently an established annuity provider, or are they a new entrant to this growing market?

- Does the insurer have an existing product?

- Have they implemented their product into a DC plan? The more employers/plans with group and institutional products, the more experienced the insurer.

- How does the insurer differentiate from others in the market?

Considerations When Selecting a Solution

Another key component of the annuity selection process is product offerings, which range from income annuities offered at the point of distribution to systematic withdrawal programs (SWiPs) to investment options with embedded income. Here are some considerations for you, your recordkeeper and consultant to keep in mind:

- What are the objectives of the DC plan(s) you provide to your employees?

- What is important to your plan participants in retirement?

- Are you seeking ways to enable participants to convert a portion of their retirement savings into guaranteed income they can’t outlive?

- What solutions best meet your plan objectives, and which will be the easiest to implement?

- What solution would be the best complement to the options already in your plan?

- What options will be simple for plan participants to understand?

When evaluating annuity options available in the DC market, 96% of consultants rank lifetime guarantees and simplicity as the most important product attributes.7

- Does the product allow participants flexibility in selecting the amount they want to annuitize and determine when they want to receive the income?

- Partial annuitization is a best practice, allowing the participant to have access to some of their savings in retirement.

- Does the solution offer portability for your participants?

- At the plan level?

- If you change recordkeepers?

- Does the solution have the continuity to stay with your plan and your participants for the foreseeable future?

For a deeper dive into the products available in the market, read our 2024 whitepaper DC Plan Design: Facilitating Income Replacement in Retirement.

Assessing an Insurer’s Processes

Another important area to evaluate is the way the annuity provider implements products and related services. Experience shows having strong customer support throughout the purchase journey may lead to more successful retirement outcomes. Participants need support to understand what they are buying and, since these are long-term products, need to be reminded of what they bought. Here are some points for you, your consultant and recordkeeper to discuss in relation to both the plan sponsor and participant experience.

- Plan sponsor and recordkeeper experience

- What is required for implementation of the solution?

- How does the insurer protect data security?

- Does the insurer prepare a customized timeline/project plan for implementation that outlines all milestones, sets expectations, and allows the plan sponsor to measure and keep track of the progress?

- How experienced and knowledgeable (including professional credentials) is the team responsible for implementing new products and services?

- Does the insurer provide timely issues resolution, as well as accurate, ongoing reporting of critical plan data, such as annuitization data and service levels, etc.?

- Participant experience

- Is the annuity purchase process—from initial quotes to point of purchase—easy to understand?

- Do welcome packets set a friendly tone, and clearly and comprehensively address participants’ needs?

- Is the participant portal setup user-friendly, with additional support available if needed?

- Is the quality of customer service via a call center highly rated by an independent, third-party?

- How is pre-purchase and ongoing education delivered? Is there accommodation for different worker shifts, locations, languages, media preferences, etc.?

- Are post-purchase services, such as tax reporting and benefit payments, timely and accurate?

When recommending an insurer for an annuity option offered to DC plan participants, 93% of consultants rank administrative experience of the insurer (e.g., timely payment of benefits, responsive call center support, etc.) as critical or very important.8

Educating Plan Participants

A particularly significant process consideration, as noted above, is participant education. Once the plan sponsor and other stakeholders have agreed to the income annuity and it’s implemented into the DC plan, it’s time to educate your plan participants. This is where choosing the right provider with the right products for your participants and the right process comes into play. The provider and/or recordkeeper may have capabilities and services for educating plan participants. The level of consumer confidence in the provider will go a long way in making the educational materials as impactful as possible.

Before you start planning your plan participant communications, survey your workforce to better understand (1) how they prefer to receive communications about their retirement benefits and (2) what level of understanding they already have with annuities and their retirement options. Some workforces may have access to financial advisors, while others may have a “do it yourself” approach such as taking advice from friends and family. In 2023, MetLife surveyed pre-retirees to better understand their attitudes, hopes and concerns regarding retirement and identified four unique retirement mindsets.

Plan Sponsors can refer to our Retirement Mindset Infographic to better understand the four employee segments MetLife identified in our research.

Plan Sponsors can use MetLife's Retirement Mindset quiz to self-identify how they approach retirement and what next steps they may want to consider.

As you develop your employee communications plan, here are some best practices to keep in mind:

- Keep it simple when communicating with participants. Fixed income annuities are the simplest kind of annuity, and the communications should reflect that.

- Communicate the core benefit of the income annuity. Fixed income annuities are designed to protect one’s retirement savings no matter how long the individual will live.

- Educate participants early and often. Generating their retirement income is now the goal of your DC plan participants. It’s a goal that should start as early in their careers as possible.

- Take a multi-channel approach to education. Leverage your learnings from the participant surveys and our Retirement Mindsets research to understand how your participants want to learn about the retirement income options available to them.

For more best practices, read our Best Practices for DC Plan Distribution whitepaper.

Taking a Holistic Approach

Adding a guaranteed income option to your DC plan will transform your retirement savings plan into a holistic retirement program that provides guaranteed income in retirement, adding protection and predictability to this new phase of a participant’s life. Conducting the due diligence to select a trusted provider with the right product(s) and a seamless process is a rigorous undertaking, but one with a vitally important outcome: to help your DC plan participants achieve financial security in retirement.

Check out our other resources available to plan sponsors as you look to enhance your DC plans:

- DC Plan Design: Facilitating Income Replacement in Retirement

- Best Practices for DC Plan Distribution whitepaper

- Understanding an Employee’s Retirement Mindset

Learn more at metlife.com/retirementincome.