Already have a TCA?

What is the Total Control Account?

MetLife's Total Control Account (TCA) is an interest-bearing, no fee account designed with beneficiaries in mind. Although not a bank account, it's a lot like a checking account, but with several advantages.

Your loved one trusted MetLife with their life insurance or annuity, and to provide you with assistance during this difficult time. There’s no better place to protect and grow those funds than a MetLife TCA.

I want to...

Features

Easy Access to Your Funds

Selection of this slide may update corresponding content belowEarn Interest Immediately

Selection of this slide may update corresponding content belowTCA Visa Debit Card

Selection of this slide may update corresponding content belowManage Your Account

Selection of this slide may update corresponding content belowPreserving Your Loved One’s Legacy

Selection of this slide may update corresponding content belowAs you make financial decisions, you may wish to consider withdrawing from any lower interest checking or savings accounts you may have, before withdrawing funds from your Total Control Account. Because your Total Control Account isn’t a bank account – once money leaves, it can’t come back. So, letting it earn interest on its interest may offer greater long-term value.

Click here and enter your total estimated Life Insurance payment amount. The calculator will provide your potential earnings and comparisons.

Additional Benefits:

- A free Debit Card that can be used anytime, anywhere Visa is accepted

- Ability to link to your account to mobile payment services such as PayPal®, Venmo®, Cash App®, Apple Pay®, and Google PayTM

- Option to use or transfer funds from your TCA at any time without fees

- Zero maintenance or service fees

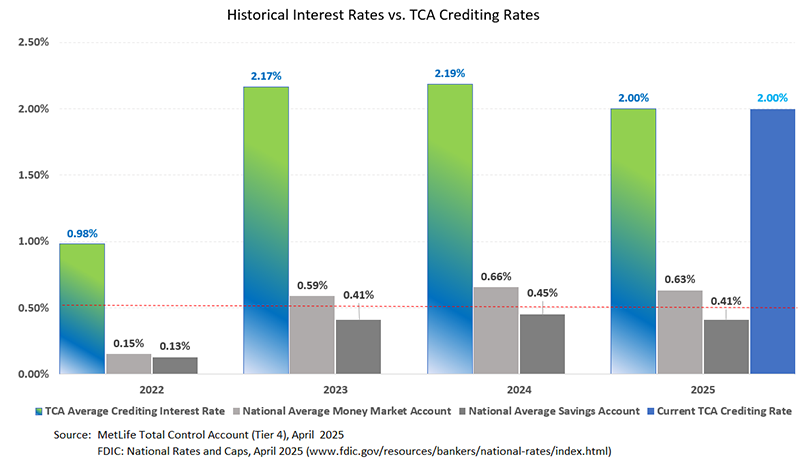

Accountholders benefit from a guaranteed minimum interest rate of 0.50% (a half percent) - which can be higher than the interest rate received on a standard checking/savings account.

The easiest way to access your funds.

The debit card offers you a safe and convenient way to access your money. With the Visa debit card, you can make everyday purchases and payments and get cash from an ATM with no fees. Enjoy peace of mind knowing that you’ll receive a proactive SMS text alert message if we suspect fraud.

Once you have a TCA account, you can order a Visa Debit Card by MetLifeTCA.com or by calling 800-638-7283.

Your TCA is easy to manage, and if you need help, we’re here for you. You can register online for fast, convenient, and secure access to MetLifeTCA.com. With MetLifeTCA.com you can view your account balance, view your current crediting rate, download statements, and more. If you already have a TCA and would like to register for online access visit MetLifeTCA.com and click Register Now.

Have additional questions? Call us Monday through Friday 8 a.m. through 7 p.m. ET and our dedicated US based customer support team can assist you.

Your TCA can serve as a legacy after your loss. You can use the funds for meaningful purchases or keep the account open and earning interest without using the funds, and then pass it along to your beneficiary(ies).

FAQs

With a TCA, life insurance proceeds begin earning interest as soon as the account is established, and the TCA interest rate is often higher than what many traditional banks pay on savings and checking accounts. TCA also provides support and flexibility to you. You can easily access funds to pay for expenses while you continue to earn interest on your remaining balance.

There is no cost to having a TCA. There are also no maintenance fees, no ATM surcharges, and no charge for withdrawals or drafts.

Yes, your account earns competitive interest. Your account begins earning interest the day it's established. We review our interest rates weekly to ensure that they are competitive, and the interest is compounded daily to give you a higher return.

MetLife fully guarantees the funds in your account (principal and interest earned). MetLife has been helping protect people’s financial security since 1868, and the TCA is backed by the financial strength of MetLife. In addition, the funds in your account are guaranteed by your state insurance guaranty association. The coverage limits vary by state.2

No. Funds for your TCA can only come from a life insurance claim or annuity closeout. When you withdraw money from your TCA, you won’t be able to redeposit it into the TCA or deposit funds into your TCA. So, if you have a checking or savings account earning less interest than your TCA, you may want to use that source before withdrawing money from your TCA.

Once your account has been established, you can access your funds a variety of ways:

- Link your TCA to your favorite mobile payment service such as PayPal®, Venmo®, CashApp®, Apple Pay®, and Google PayTM.

- Set up recurring payments to help pay for your mortgage/rent, student loans, utility bills, etc

- Use your fee-free Visa debit card (which is also an ATM card) anywhere Visa is accepted - go to MetLifeTCA.com to request your debit card

- Write drafts for $250 or more

- Transfer funds right from the website

MetLife has a dedicated customer service team ready to answer your questions.

Call 800-638-7283 Monday through Friday from 8:00 a.m. through 7:00 p.m. ET