Investment Feature

Planyour

Two reasons why you might want to invest within your GVUL policy:

- Death Benefit Protection in retirement: You can structure your investment/savings contributions such that future policy charges for life insurance protection are paid out of the certificate’s cash value. We can calculate the annual contribution projected (but not guaranteed) to be sufficient to maintain a specified amount of life insurance. Simply contact Customer Relations department at 800-756-0124.

- Tax Advantage

- Power of Tax Deferral Example

- Tax-Free Withdrawal of Cash Value (“cost recovery”): You can structure your GVUL certificate so that the contributions to your investment account, including earnings, can be withdrawn tax-free up to your certificate’s total Cost Basis (the sum of all premiums paid into the certificate less any prior nontaxable distributions)1 . Simply contact Customer Relations at 800-756-0124 and request a “cost recovery” calculation.

Understanding Your Policy Cost Basis

Are you aware that you don’t have to die for your GVUL policy to have value! There is a living benefit to your policy in the form of an optional tax-advantaged investment feature2.

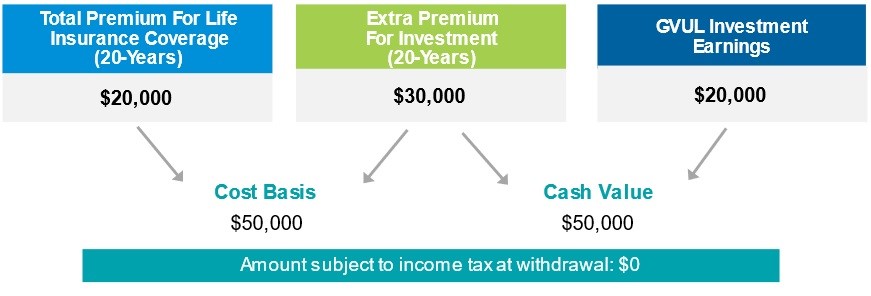

GVUL cash value withdrawals are taxed under the “cost recovery rule,” which means that so long as certain premium limitations are followed, distributions are only taxed to the extent they exceed the investment in the policy (ie: Cost Basis). Cost basis includes not only the extra premium dollars you invest but also the aggregate premiums paid for the monthly cost of insurance going back to the first day you were enrolled in the plan. This includes not only the premiums paid by you but also the premiums paid by the County of Los Angeles. Nontaxable distributions reduce cost basis.

The premiums paid for the cost of life insurance and all optional investment contributions premiums are combined to create your aggregate cost basis.

Regardless of whether you are investing now or not, every month premiums are paid your cost basis increases! We will continue to track your cost basis for as long as you maintain your GVUL coverage.

Cost Basis = Total GVUL premiums paid, including premiums paid for life insurance protection and extra premiums contributed to the investment

Cash value = The sum of all additional premiums contributed for investment, plus any investment earnings on those investment premiums.

Tax Advantage = Cash value can be withdrawn tax-free, including earnings, as long as the amount withdrawn does not exceed the accumulated Cost Basis

Tax-Treatment of GVUL Premiums - Hypothetical Example Policy Issue Age: 40 / Death Benefit : $500,000 Extra Preminum for Investment: $125/month

Your Cost Basis offsets dollar for dollar

any gains in your cash value upon withdrawal.

How do I find my personal Basis:

- Online at www.mylacountybenefits.com

- Appears on your annual statement mailed in January

- By calling customer service at 800-756-0124

Purchasing life insurance while investing separately.

All potential gains from the money invested are subject to tax. The life insurance premium is an expense only.

Plan ahead

Make an informed decision and view a short video on the benefits of GVUL coverage from MetLife.

To speak with a GVUL Benefits Specialist, call 800-756-0124,

Monday - Friday, 5:00 am - 5:00 pm PT