MetLife andAura

Employees need protection from digital crime now more than ever

Employees and their families do nearly everything online. But as digital crime continues to soar, this convenience puts what’s important to them at risk: their assets, identities, family, and tech.

MetLife + Aura’s solution is a smart, simple way for employees and their families to stay safe online.

An award-winning solution brokers & employers can feel good about offering

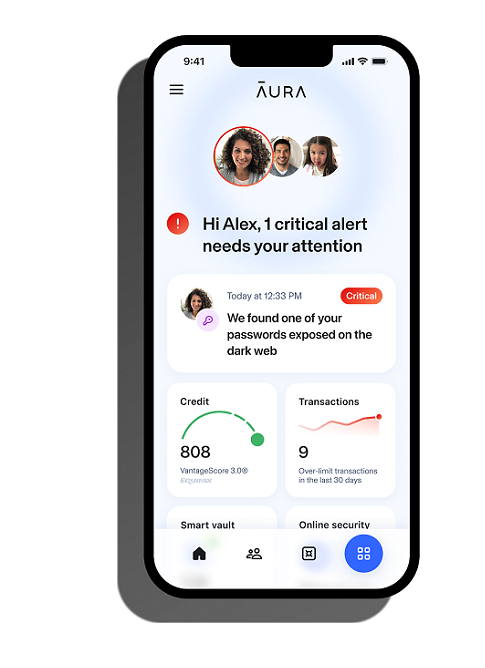

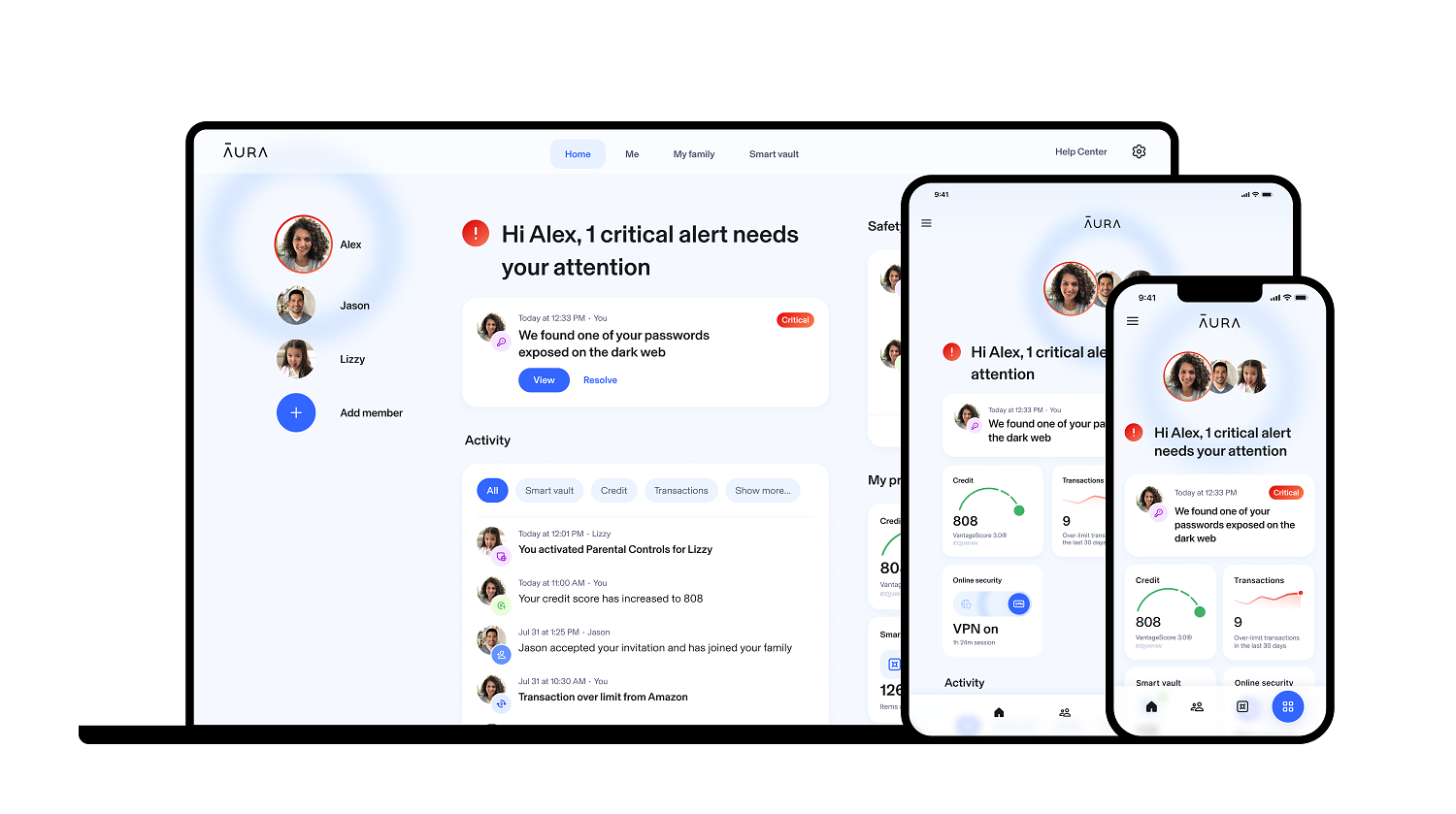

Our solution offers smart, proactive protection to help employees and their loved ones get ahead of online threats. It’s easy to use, all in one app, and accessible across devices.

- Highest Rated in App Store (4.6 stars)

- Highly Rated by Industry Experts

- Rated Best Overall in Recent 2022 Mystery Shopper Study

Our solution offers protection for every stage of life.

We're different where it matters

Our product goes beyond traditional identity theft solutions, consolidating multiple fragmented solutions and apps into a single, easy-to-use experience to provide robust digital security for employees and their entire family.

- All of the features, none of the complexity. Our product is easy to use while offering one of the richest features sets – accessible from your favorite devices via the online dashboard or all-in-one app.

- Automated features, not a to-do list. Our solution is simple and full of automation so employees will actually use it and stay better protected.

- Fraud alerts within minutes –not hours or days later. Proven to be the fastest, most reliable identity theft protection solution4, alerting to credit fraud up to 250X faster than other solutions.

- The broadest family protection, no restrictions. Get unique, fully integrated family safety features to help keep loved ones safe online. Protect unlimited minors, and up to 10 additional adults with ZERO restrictions, and each adult gets their own private, full-feature account and $5M insurance policy.*

- Continuously innovating and developing features to help stop fraud before it happens. We want to make the internet a safer place for everyone. And we believe that innovation shouldn’t come with a price tag – that’s why new features are automatically pushed to the end user at no additional cost.

Product Services

Identity & Theft Protection:

Aura monitors your personal info, accounts, and online reputation and alerts you if we detect threats. We’ll automatically request removal of your info from online sources to help keep it out of the hands of identity thieves and spammers.

Financial Fraud Protection:

Stay a step ahead of threats with credit and bank account monitoring, and financial tools to help keep your assets safe.

Privacy & Device Protection:

Connect online more securely and privately with intelligent safety tools that help protect your passwords, devices, and WiFi connection from hackers.

Service and Support

100% U.S.-based Customer Care available 24/7. Plus, victims of fraud can count on our white glove fraud resolution services and are backed by a $5M insurance policy*.

Family Safety

We make it easy for parents and caregivers to protect vulnerable loved ones online with fully integrated family digital safety tools. Family plans cover 10 additional adults and unlimited minors.

Identity & Fraud Protection

Helps protect the things employees care about most.

Parental Controls

We help make it easy to protect your children online.

Credit & Financial Transaction Monitoring

We help keep your money and assets safe.

Call and Text Protection

We help reduce the risk of falling victim to text and phone scams.

FAQ's

Employees and their families do nearly everything online. The more they search, stream, and scroll, the greater the risks of identity theft and other cyber threats. Employees are concerned about digital crime and want a solution to help protect them and their families. Our award-winning solution is both feature-rich and easy-to-use, so you can feel good about adding identity and fraud protection to your current benefits suite.

MetLife + Aura offers the following advantages:

- All of the features, none of the complexity, our product is easy to use and highest rated by customers

- Automated features, not a to-do list

- Fraud alerts within minutes – not hours or days later

- The broadest family protection in the industry

- Fully integrated into MetLife’s systems and service model, simplifying administration – enjoy 1 contract, 1 file, 1 account team

We offer multiple plan tiers to give customers the flexibility to choose the funding option, plan and coverage best fit for their unique needs:

- Protection Plan - Core protection for your identity, finances, privacy, including 1 credit bureau monitoring and two devices per adult member. Available for Individual or Family coverage.

- Protection Plus Plan – Comprehensive protection for your identity, finances, privacy, including 3 credit bureau monitoring and unlimited devices per adult member and financial wellness features. Available for Individual or Family coverage.

Individual covers the employee only. Family covers the employee, unlimited minors (under 18) and up to 10 additional adults. There are zero restrictions around who can be defined as an adult “family member” – no matter their age, relationship or whether they live at the same address as the employee.

For more details on the plan options, click here.

Yes! We encourage you to contact your local MetLife representative for a product demo. Seeing the product first-hand is a great way to understand the superior user experience we offer.

Our mobile-first approach ensures a consistent user experience across devices. Members can access their protection from wherever they go via the online dashboard or Aura's highly rated, all-in-one mobile app. Members will not need to download separate apps for specific features, and our app is the highest rated (4.6 stars in the App Store) compared to other major competitors.