Despite concerns, small businesses are still upbeat

Key Takeaways

- Small business optimism remains intact despite some troubling signs in the economy and uncertainty about where it’s heading

- A strong majority expects revenue to increase in the next year, even with the uptick in concern about revenue challenges.

- Findings vary by generation with Gen Z or millennial-owned small businesses more likely than those owned by Gen Xers to be positive about U.S. and local economies.

We are living in perhaps the most uncertain time in decades. As a new administration makes its presence felt, the changes are coming in rapid-fire succession, presenting new challenges and new opportunities for small businesses. Our newest Small Business Index reveals the Jekyll and Hyde nature of their expectation and how they’re adjusting in real time to a changing business landscape.

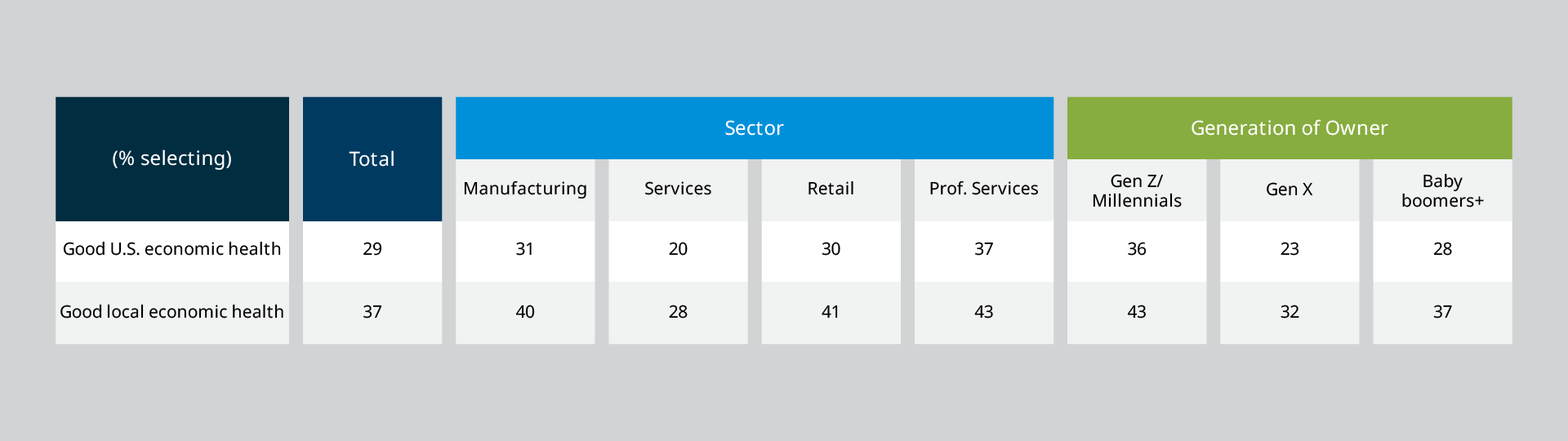

Start with how they’re feeling about the economy. Of small businesses surveyed in the Small Business Index 2025 published by MetLife and the U.S. Chamber of Commerce, 29% feel that the U.S. economy is in good health, down only slightly from last quarter (32%) and this time last year (32%). And when it comes to their local economy, around two in five small businesses (37%) say it is in good health, similar to where it was throughout 2024.

But a more nuanced picture emerges when these small business attitudes toward the economy are examined by sector and generation.

By sector, those in services are significantly less likely than other industries to say that the national economy is in good health. Manufacturing, Retail, and Professional Services score notably higher than average in positive feelings about both local and national economies. Similarly, Gen Z and millennials are more likely to feel good about those economies than their Gen Z and Boomer counterparts.

So, what’s driving the anxiety small businesses are feeling?

The revenue picture for small businesses is a mixed bag.

For small businesses, revenue anxieties appear to be growing, not surprisingly, right along with concern about rising inflation, now at its highest level since the Index began tracking this issue. Concerns over revenue increased by 10 percentage points to 35% this quarter (compared to 25% in Q4 2024). This double-digit jump puts revenue at its highest level of concern for small businesses since Q3 2021 when the pandemic was raging (34%), and tracking revenue as a concern among small businesses began.

The jump in revenue concerns were most pronounced among businesses in the manufacturing (+16%) and professional services (+14%) industries. Regionally, businesses in the Midwest (35% vs. 19%, +16% quarter-over-quarter change), the South (34% vs. 21%, +13%), and West (39% vs. 26%, +13%) saw even more dramatic changes. also saw significant increases in concern with revenue, catching up to businesses in the Northeast, which actually saw a slight decrease, dropping to 33% from 36%.

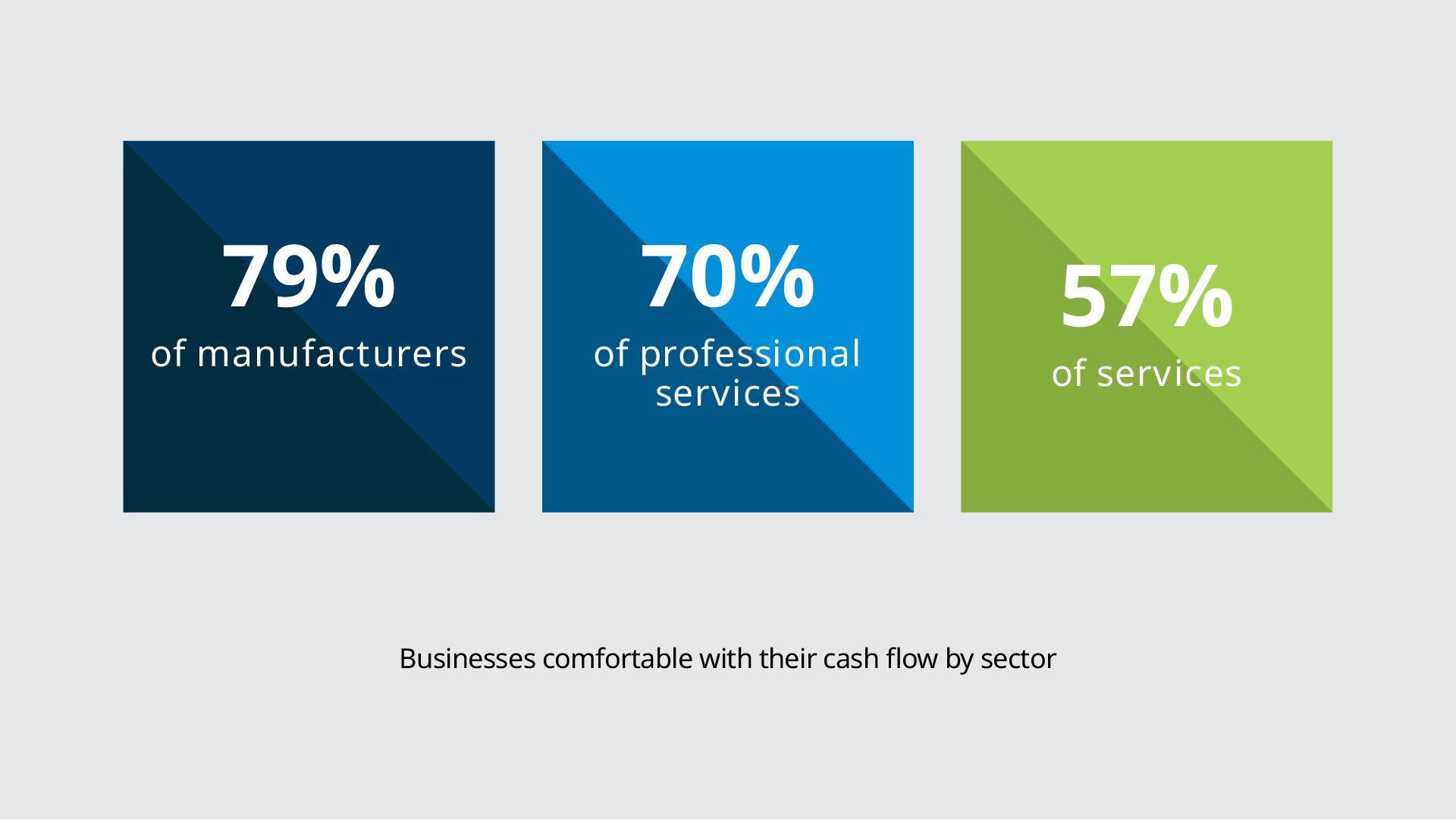

Yet, somewhat paradoxically, nearly seven in ten small businesses (63%) say their business is in good health this quarter, down only slightly from last quarter (67%). Similarly, 66% now say they are comfortable with their cash flow, which is down from last quarter (72%), but stable from one year ago (67%). That said, comfort with cash flow varies greatly. Small businesses in services (57%) are considerably less likely than those in manufacturing (79%) and professional services (70%) to say that they are comfortable with their cash flow. Additionally, those in services are less likely than other sectors to report they have increased staff in the past year (9% vs. 21-31%, respectively).

Concerns aside, small businesses look to capitalize on opportunities

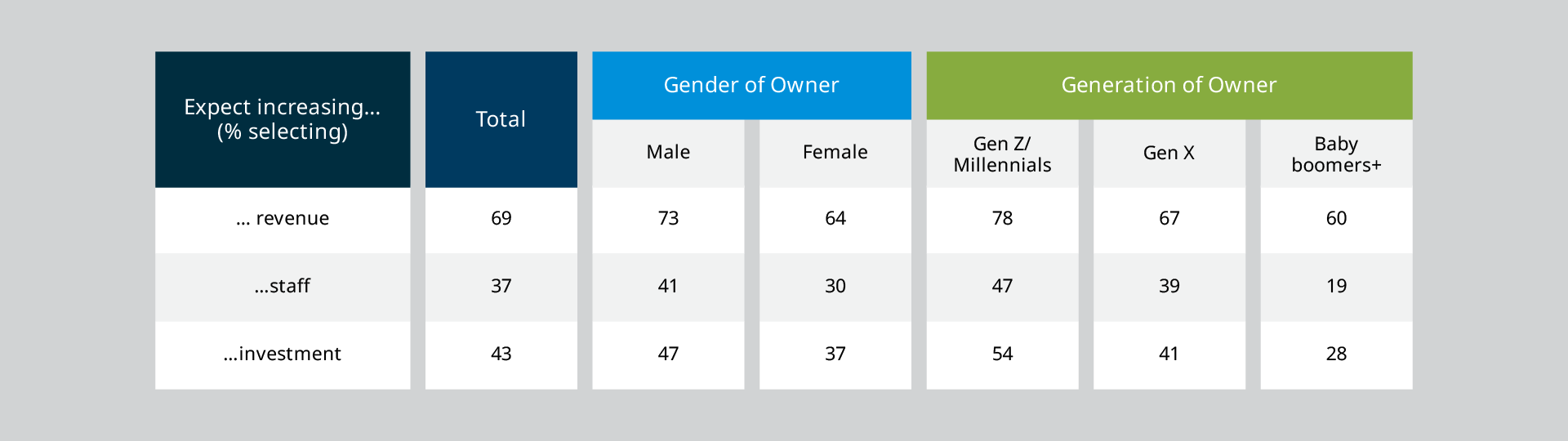

Even with the nagging worries nipping at their heels, most small businesses remain optimistic about their future. That sentiment is reflected in expected increases in hiring, investment, and revenue, even though there has not been a significant increase in those expectations since Q2 2024. Despite their worries, a strong majority (69%) of small businesses say they expect revenue to increase in the next year. In addition, 37% expect to increase their staff and 43% say they plan to increase their investment in the next year. Compared to Q1 2024, small businesses are more likely to say that they will increase their investment (43% vs. 36%).

By sector, small businesses in manufacturing are more likely than those in services to say they expect to increase investment. Those in manufacturing are also more likely than all other industries to plan on increasing staff in the next year by a whopping margin (56% vs. 25-37%, respectively).

As with the perceptions of local and national economic conditions, each measure of business expectations – future increases in revenue, hiring, and investment – varies significantly by gender of owner and generation of owner. Male owned small businesses are significantly more likely to expect increases in investment, staffing, and revenue.

Along these same lines, small businesses owned by Gen Zers, millennials, and Gen Xers are more optimistic about future hiring and investment compared to their Baby Boomer and older generation counterparts.

In order to see their expectations come to fruition and avoid the trap doors that they potentially face, small businesses are looking for solutions that enable them to hire aggressively, responsibly direct funds toward needed investments, and continue growing. To that end, many are discovering a simple, cost-efficient new approach to benefits. One that’s designed to meet their budgetary requirements while enabling them to successfully compete for the kind of workforce talent that in the past has typically ended up in larger, more well-funded organizations. See how MetLife's Small Market Experience is playing a central role in impacting the way small businesses operate by helping them efficiently build a happier, more engaged and productive workforce.