Small businesses weather the storm as inflation remains a top concern in 2025

Key Takeaways

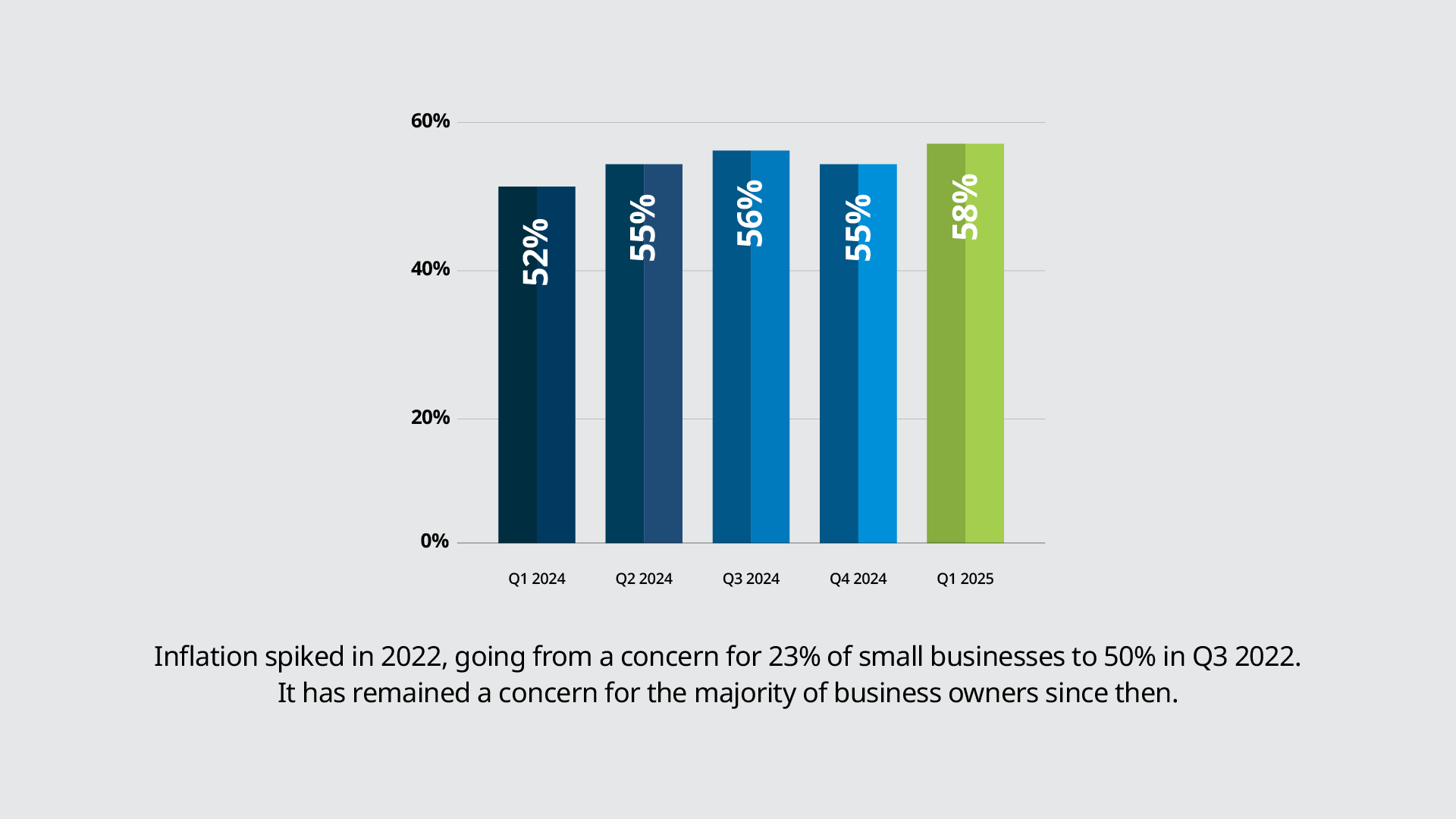

- Inflation has reached a record high as a concern for small businesses, with 58% citing it as a major issue, up from 19% when records started in Q1 2021

- Revenue concerns have also surged (35%), increasing by 10 percentage points from last quarter and highlighting growing financial uncertainty

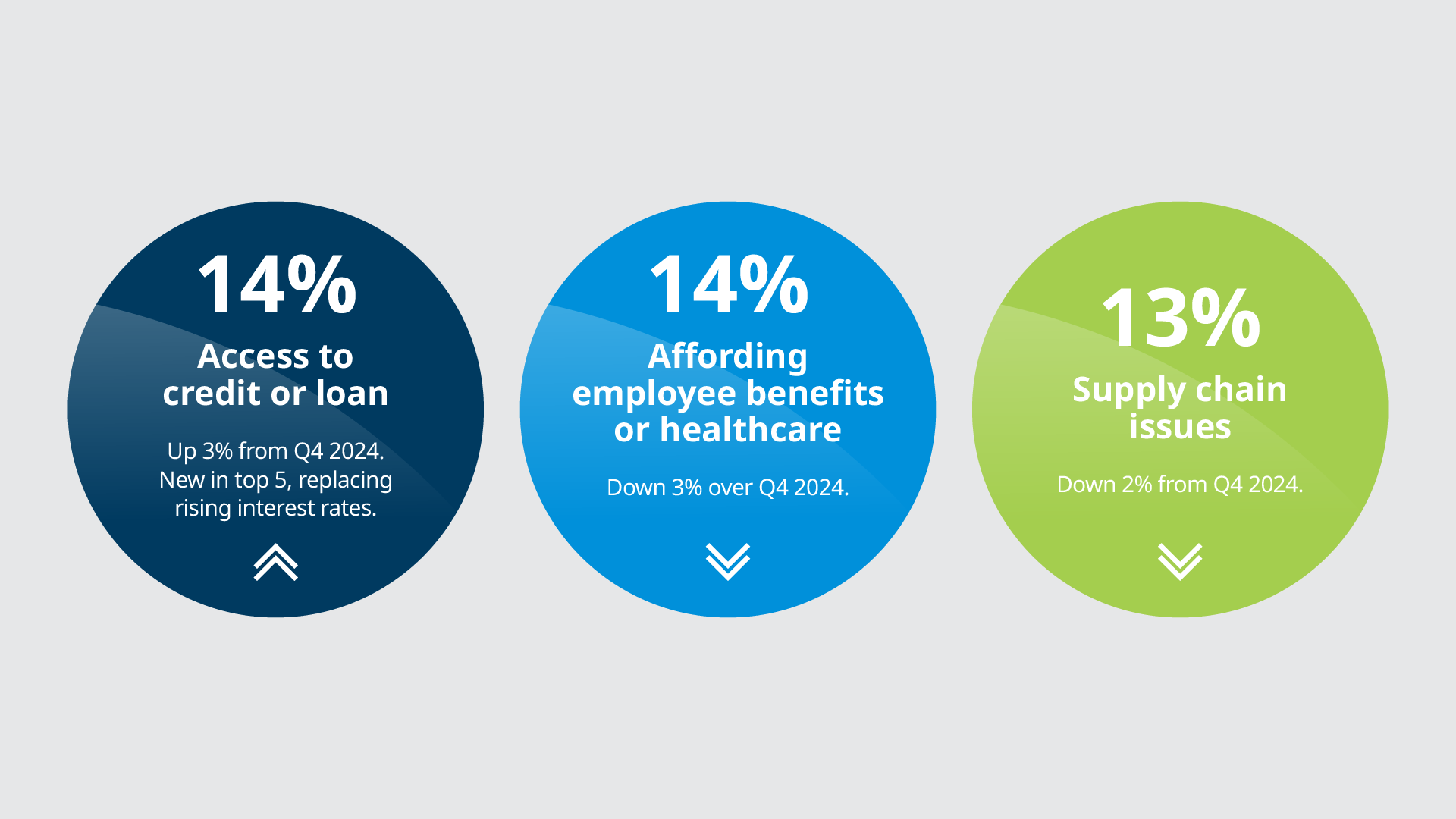

- Access to credit has replaced rising interest rates as a major concern, ahead of benefits affordability and supply chain issues

For the 13th consecutive quarter, inflation has remained the top concern for small businesses. This persistent economic pressure has created a perfect storm for business owners, who find themselves caught between a rock and a hard place. On the one hand, they face mounting costs for goods and services, which steadily chips away at their profit margins. On the other, they must navigate the murky waters of revenue uncertainty in today's volatile economic landscape.

In response to these challenges, many business owners are rolling up their sleeves and implementing various strategies to stay afloat—from adjusting their pricing structures to trimming operational expenses to rethinking employee benefits—just to maintain their bottom line.

Let’s take a closer look at what’s keeping business owners up at night using data from the recently released Q1 2025 Small Business Index, a comprehensive study jointly conducted by MetLife and the U.S. Chamber of Commerce.

Nearly six in 10 business owners feel inflation’s effects, with uneven impact across the landscape

Inflation concern has hit a record high, with 58% of small businesses citing it as a major concern. This is up from 52% last year, though the recent quarterly increase from 55% isn't statistically significant.

The impact varies significantly across different business segments. Moderately stable companies (67%) are caught in the middle as they have neither the cushion of successful businesses or the support systems available to struggling ones.

Regionally, Midwest businesses are particularly affected (65%), with higher inflation in housing (5.0%), services (4.6%), and fuel (3.7%) driving down consumer spending and hurting their bottom line1.

Age is also a factor, with Baby Boomer business owners showing greater concern (64%), likely due to more limited access to capital and less technological adaptability compared to younger counterparts.

Small business revenue worries surge to new heights

Revenue concerns have surged significantly this quarter, jumping 10 percentage points to 35% and becoming the second most pressing issue for small businesses for the fifth consecutive quarter. This marks the highest level of revenue anxiety since we began tracking this metric in Q3 2021.

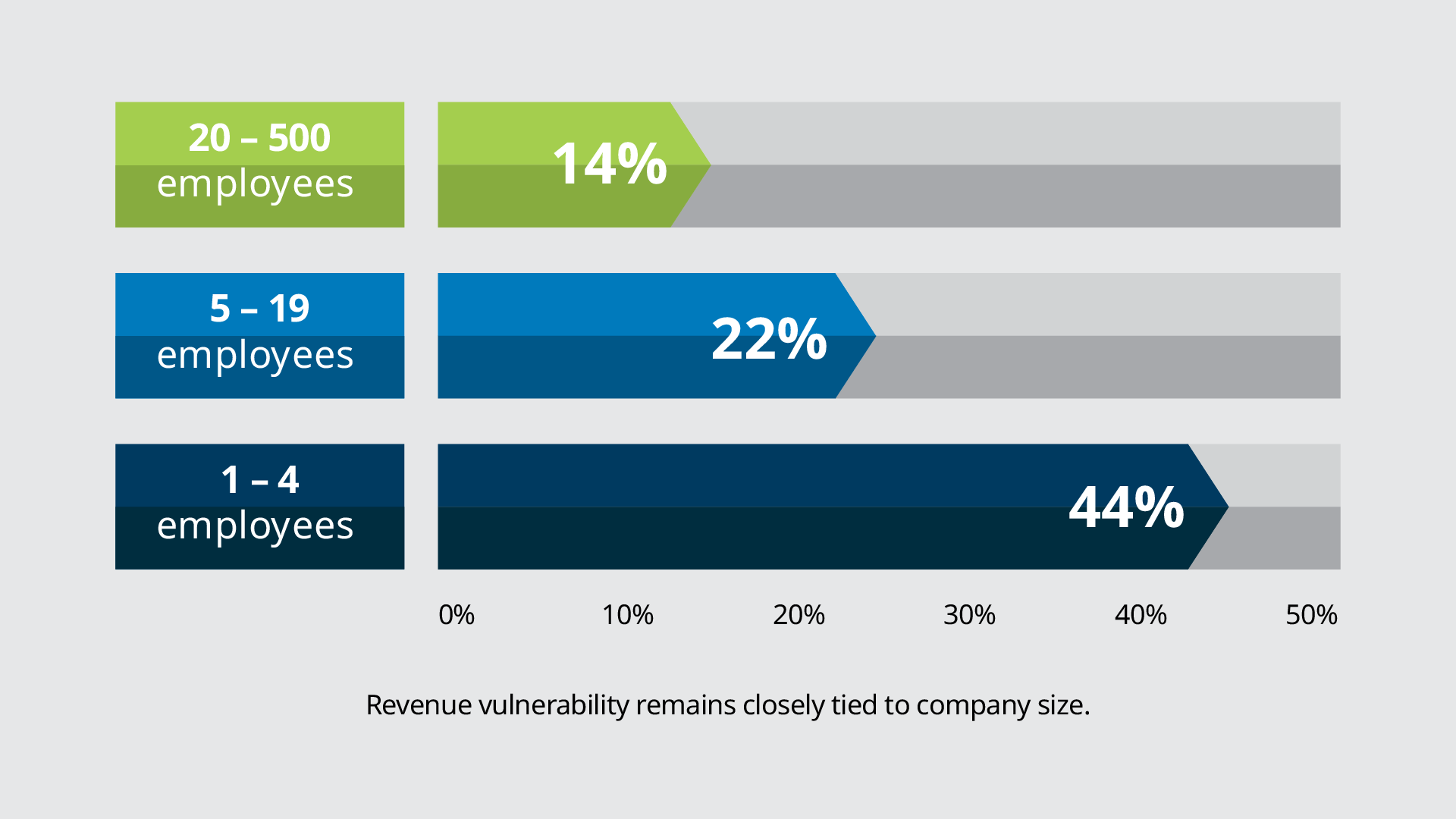

The smallest companies continue to worry most about revenue, following the same pattern we saw last quarter. Micro-businesses with just 1–4 employees are feeling the most pressure, with 44% citing revenue as a major concern. This anxiety decreases dramatically as company size increases—only 22% of businesses with 5–19 employees share this level of concern, dropping further to just 14% among larger small businesses (20–500 employees).

Manufacturing and professional services have been hit particularly hard, with concern levels spiking by 16% and 14%, respectively. The regional picture is also telling: while the Northeast has maintained stable concern levels (33%, down slightly from 36%), the rest of the country is catching up rapidly. The Midwest saw the most dramatic increase (from 19% to 35%), with the South and West both experiencing 13-point jumps.

This widespread revenue anxiety likely stems from a mix of challenges including persistent inflation, escalating costs, tightened capital access, and ongoing trade uncertainties.

Calmer conditions reported on healthcare, credit, and supply chain fronts

Beyond inflation and revenue worries, small businesses are less concerned about other challenges. Only about 14% worry about affording employee benefits or healthcare and accessing credit, while 13% cite supply chain issues and 12% mention interest rates.

There are some regional differences, though. Southern businesses struggle more with credit access than those in the Midwest (17% vs 9%), while Midwestern companies are more troubled by supply chain issues than Northeastern ones (18% vs 10%).

On the supply chain front, proposed import tariffs threaten to drive up costs for businesses with global suppliers and potentially reduce consumer spending by up to $78 billion annually2. Many companies are responding by seeking domestic suppliers or adjusting their pricing strategies to protect profits.

Choosing between cost-cutting headwinds and investment tailwinds

With affording employee benefits cited as a key concern, it’s worth mentioning that cutting employee benefits to reduce costs often harms overall business health. In today's economy, it’s best to treat these benefits as strategic investments rather than expenses.

When businesses maintain strong benefits during challenging times, they foster the employee engagement and loyalty needed to navigate financial difficulties and prepare for growth. MetLife's Small Market Experience makes this possible by empowering small businesses to offer comprehensive non-medical benefits comparable to those of Fortune 500 companies, regardless of size.