For business owners, change is in the air as small business cash flow comfort drops

Key Takeaways

- It’s a period of rapid, intense and unpredictable change for small business owners with no clear picture of where things are heading.

- Their essential optimism about the economy – while tempered – holds steady as they figure out how to play the hand they’ve been dealt

- Even so, pulling back on adding staff and investing in their companies is not an option, leaving them searching for solutions.

Perhaps at no other time in recent memory have so many things changed so rapidly for small business owners. The remote work/return to office battle rages on. Tariffs are upending long held assumptions about the price of everything from food to building materials to steel and more. The emergence of artificial intelligence (AI) is ushering in new possibilities – as well as new anxieties. And as their numbers gradually replace boomers as the most in the workplace Gen Z is coming in with new expectations that are altering – sometimes dramatically -- the way businesses operate.

Not surprisingly, business owners are proceeding with caution as they navigate new and unfamiliar terrain. But even so, their optimism about the future seems to be intact. Over three-fifths of small businesses (63%) say their business is in good health this quarter, down only slightly from last quarter (67%).And while the number of business owners that say they are comfortable with their cash flow (66%) has seen a significant dip since last quarter (72%), it remains stable compared to one year ago (67%).

While uncertainty gives business owners pause, plans to add staff hold steady

One thing that hasn’t changed is plans to hire. One in five (20%) small businesses report having increased staff in the past year, in line with Q4 2024 (22%). Given how they feel about entry-level employees and the importance of attracting new talent that isn’t especially surprising. Most small businesses say the quality of applicants is good and are keenly aware of how important hiring well is for their continued growth.

Of the small businesses that evaluated the quality of new recruits, a majority (59%) say the quality of these potential new workers is good or very good, unchanged from Q2 2022 (60%). This optimistic outlook on applicants is a marked departure from just seven years ago, when many more small businesses rated the quality of potential recruits as fair or poor rather than good.

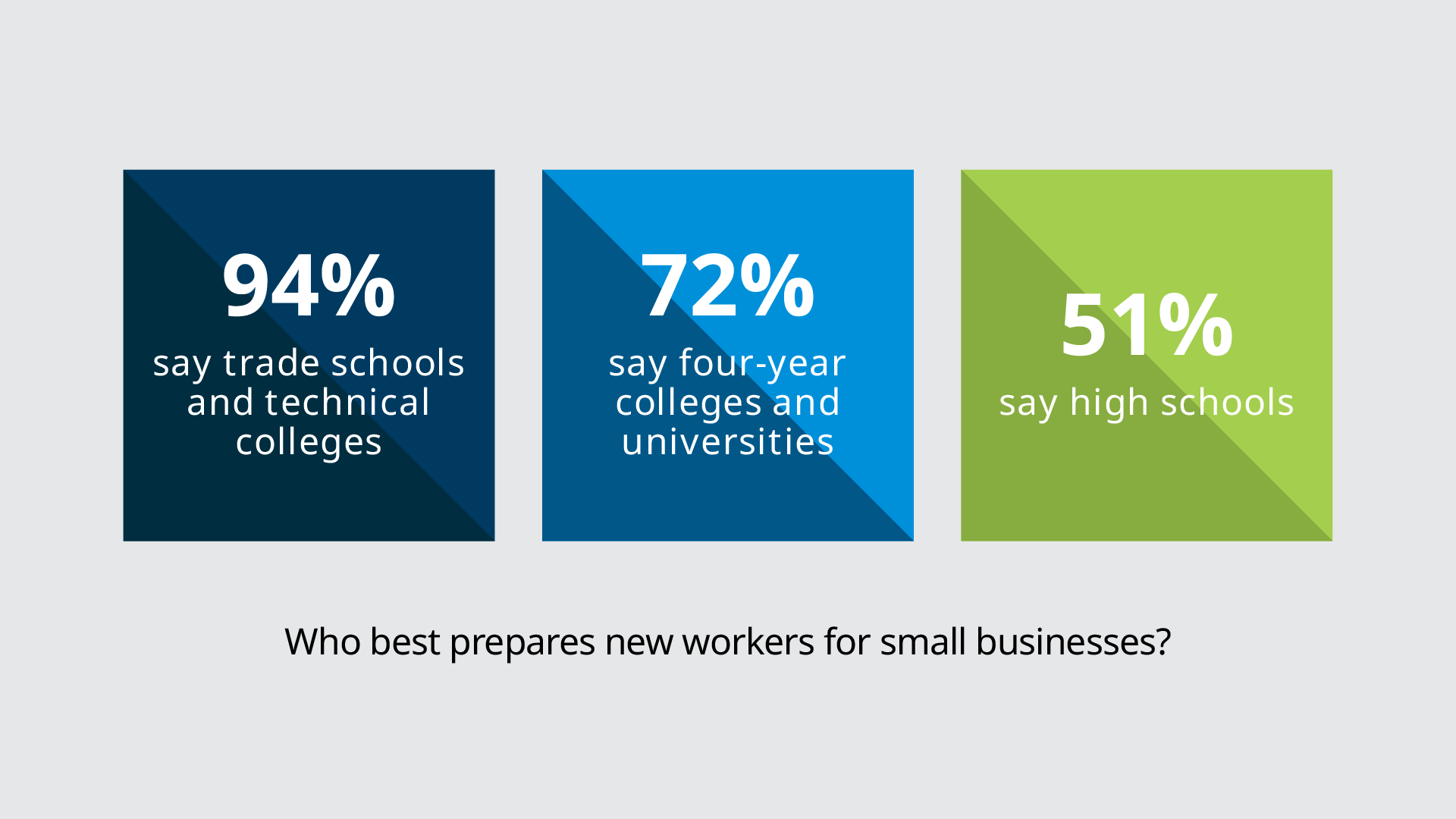

Adding to the good vibes business owners feel toward new employees is how well they’re being prepared to enter the workforce. Nearly all small businesses say trade schools or technical colleges are very or somewhat effective at preparing new employees for the workforce, followed by traditional colleges and high schools.

Squeezed between a cash flow crunch and an unpredictable economy

What’s coming down the road? That’s the million-dollar question on the minds of many owners and it’s affecting how they feel about their businesses. While nearly 3 in 10 say the U.S. economy is in good health, and around two in five small businesses (37%) say their local economies are in good health, concerns about inflation, revenue, cash flow, and confidence in overall business health remain.

Jitters about revenue increased by 10 percentage points to 35% this quarter -- its highest level since Q3 2021 (34%), when tracking began. A still-strong majority (69%) of small businesses say they expect revenue to increase in the next year, but their enthusiasm is somewhat muted, with a 4% decrease off record highs reported last year (73%) in Q2 and Q3.

And while 66% of small business owners still say they are comfortable with their cash flow, that’s down a surprising six points from just last quarter – a troubling trend since cash flow management is such a key driver of small business stability. Also, confidence in business health has dipped slightly (63% this quarter, down from 67%). And inflation continues its reign as the top worry for small businesses, with 58% of small businesses citing it as their top concern -- the highest level since tracking began and an increase of six percentage points compared to this time last year.

Investment remains an important priority

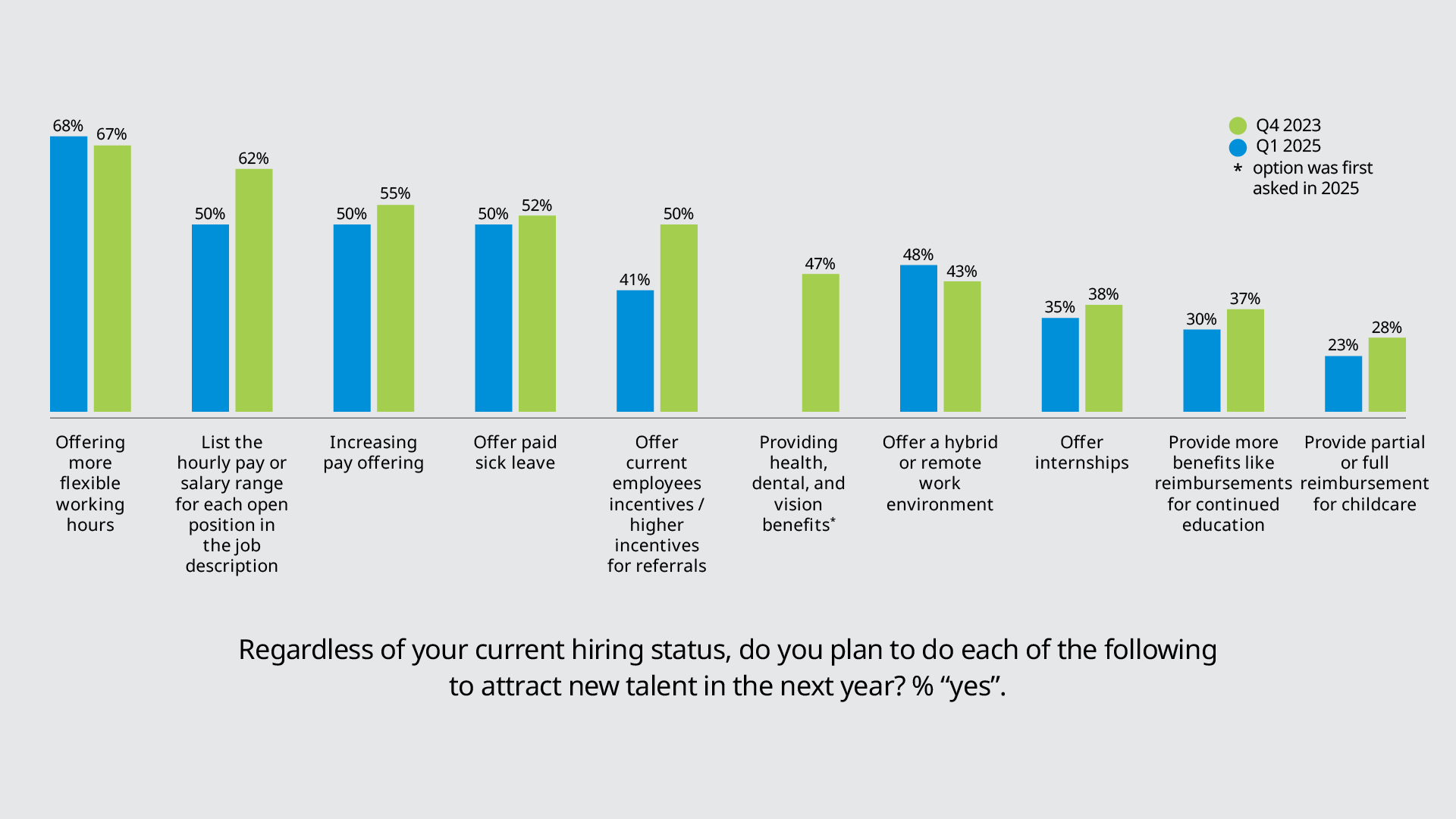

Even with all the uncertainty and nervousness, most business owners feel they have to invest. So, what does that look like? Especially for Gen Z- and Millennial-owned businesses it means a greater likelihood of offering a variety of benefits compared to businesses owned by their older counterparts. Planned offerings for employees include not only increasing pay (55%), but offering sick leave (52%), offering current employees higher incentives for successful new employee referrals (50%), and providing health, dental and vision benefits (47%). Similarly, businesses in operation for 10 years or less and small businesses with 20-500 employees are also more likely to offer most of these benefits compared to their older or smaller counterparts. By industry, services businesses tend to be the least likely to offer many of these benefits, while manufacturing is the most likely.

As a new generation of workers with higher expectations for what they want from employers enters the workforce, the challenge owners face is how to invest in a way that supports employees without compromising their cash flow. For small businesses, that means becoming more innovative so they can offer the same benefits as their larger competitors. See how more and more of them are turning to MetLife's Small Market Experience to provide the benefits their employees want while nimbly and successfully navigating a rapidly evolving business environment.