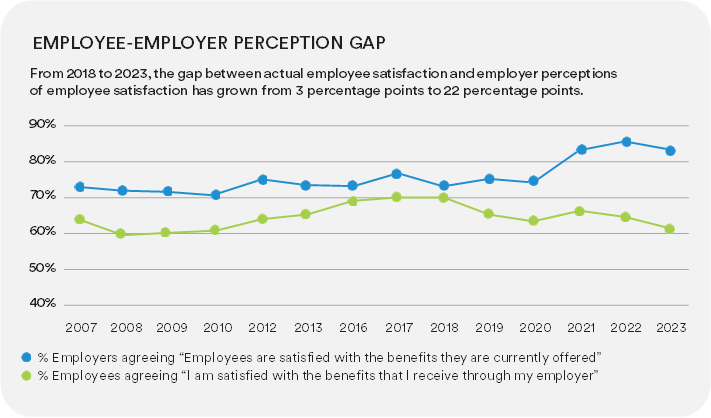

Against a backdrop of historically low job satisfaction, dwindling employee loyalty and declining holistic health, MetLife’s research shows that employee benefits satisfaction has also fallen to its lowest point in 10 years.1 But that’s not the way employers see it.

Over the last five years, the gap between actual employee satisfaction and employer perception has grown by 18 percentage points. This gap is partly driven by employee expectations outpacing what employers are offering.

86% of employees are interested in their employer providing an HSA

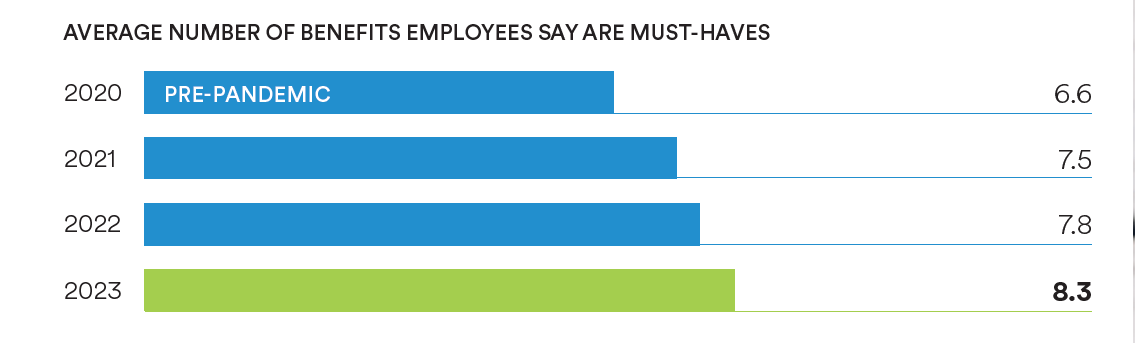

Employees expect a wider range of benefits from their employers.

At the start of the pandemic, the number of benefits that employees considered to be “must-haves” rose sharply. Three years later, the number of must-have benefits continues to rise steadily. A tight labor market, a generational shift in the workforce, greater diversity in employee populations and an increased focus on health and well-being may all play a role in this trend.

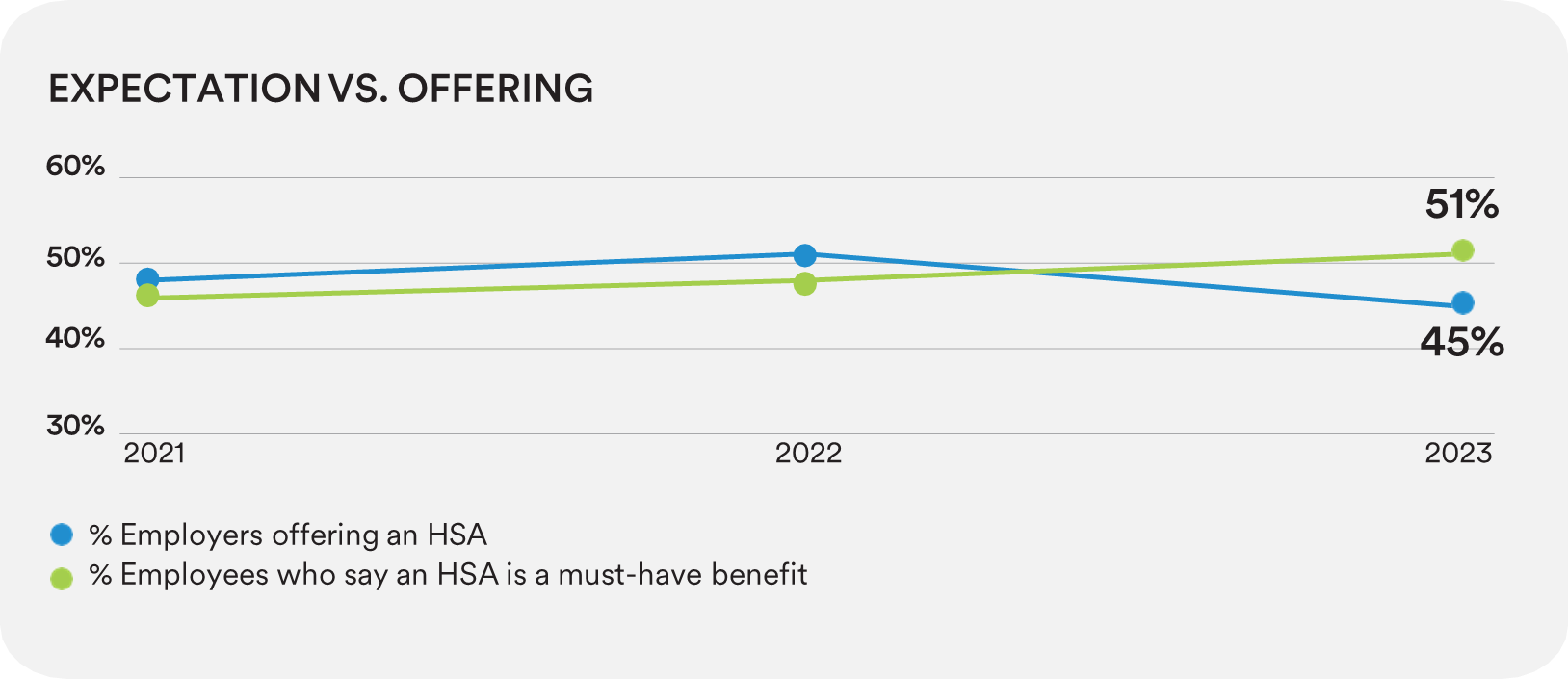

A Health Savings Account (HSA) is one of the new must-haves for employees.

Beyond the expected standbys like medical and dental insurance, most employees now also expect a Health Savings Account (HSA), and it’s a trend that’s gaining momentum.

Why? An HSA, offered alongside a High Deductible Health Plan, provides a triple tax advantage. Employees can use pre-tax dollars to pay for qualified healthcare expenses and enjoy tax-free asset growth for future needs, like retirement healthcare expenses.

Right now, the addressable market for HSAs is poised for growth: 86% of employees are interested in their employer providing an HSA, an increase of 5 percentage points over just two years ago.

Yet the number of employers offering an HSA has fallen.

Over the past three years, the number of employers reporting that they offer an HAS to employees has fallen by 3 percentage points. This is where the opportunity exists for employers and benefits consultants to understand employee benefits expectations and how HSAs can benefit their employees and their business.

HSAs can help promote financial health and well-being for all employees.

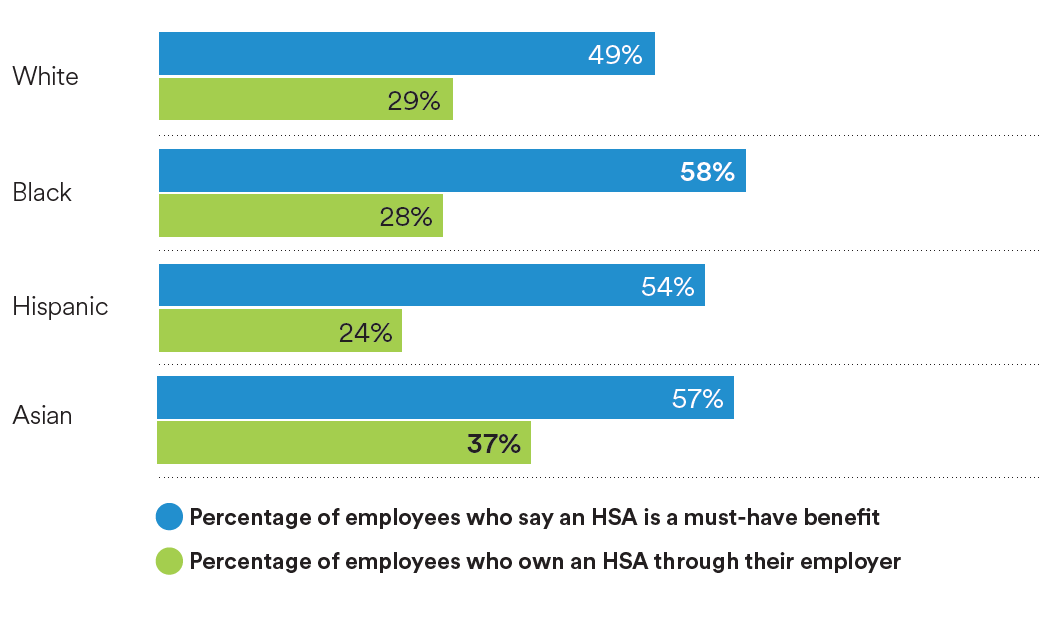

Health expenses are a top source of financial stress and anxiety for all employees,2 more so for groups who have been denied opportunities in education, employment and building financial security. Financial tools like HSAs have the potential to help close the equity and wealth gap by building financial confidence and resiliency among under-represented groups. To support their plans for diversity, equity and inclusion (DEI), employers can offer a wider range of benefits to help meet the needs of their workforce.

MetLife’s research shows that although interest in an HSA is higher across under-represented groups, only employees who identify as Asian have a higher degree of adoption.

Younger employees are more interested in HSAs.

Demand for HSAs is lower among Boomers, but consistently above half for Gen Z, Millennials and Gen X. Despite a high level of interest, the levels of ownership are much lower among Gen Z. Given their higher interest, adoption among younger employees may soon surpass that of Boomers.

Employees with HSAs can benefit today and in the future.

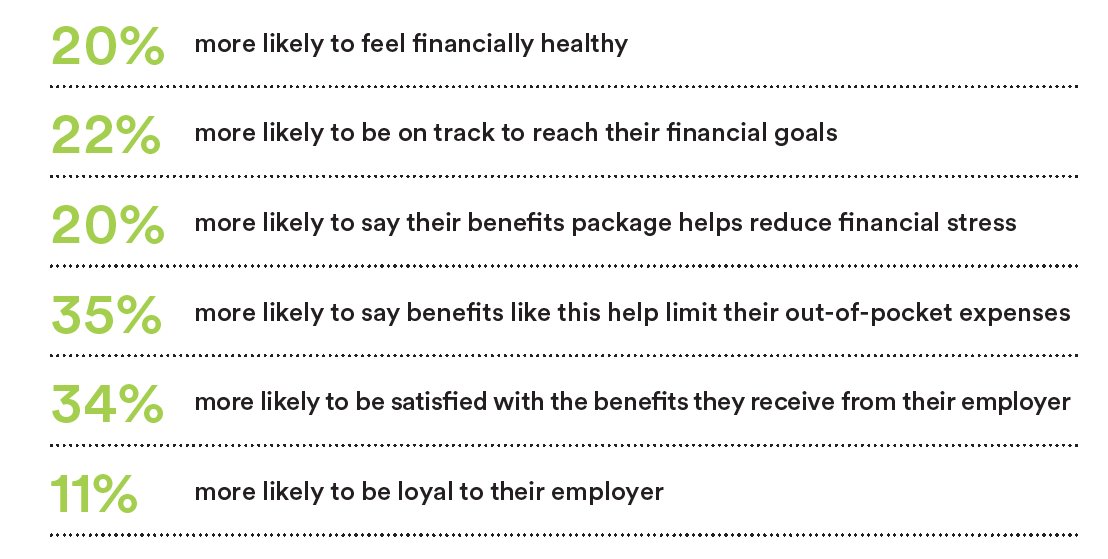

Third-party sources have identified HSAs as a tool that Gen Z and Millennials are using to save for future healthcare costs in retirement, believing 401(k)s are not sufficient.3 But employees don’t need to wait until retirement to benefit. Compared to employees who don’t have an HSA, those who currently own an HSA through their employer are:

HSAs are one part of MetLife’s comprehensive suite of Health Savings & Spending Accounts designed to deliver the benefits employees want. These accounts can help employees reach their financial goals while helping your clients demonstrate employee care. To find out more, visit: Health Savings & Spending B2B | Insurance | MetLife

1. MetLife’s 21st Annual U.S. Employee Benefit Trends Study, 2023.

2. MetLife’s 20th Annual U.S. Employee Benefit

3. Benefits Pro. “401(k)s are not enough for Gen Z and millennials: Why many are choosing

HSAs too.” February 1, 2023. https://www.benefitspro.com/2023/02/01/401ks-are-not-enough-for-gen-z-and-millennials-why-many-are-choosing-hsas-too/

All data from the 21st Annual MetLife Employee Benefit Trends Study unless otherwise noted.